Holiday company TUI AG (GB: TUI) released its fourth-quarter trading update yesterday, indicating a strong year-end in 2022 – boosted by a summer in which which holiday bookings returned to close to pre-Covid levels.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

The company recorded an increase of 1.4 million in summer bookings over last year, with a total of 12.9 million.

The sales are at 91% of pre-COVID levels in 2019, despite huge airport disruptions this summer. The UK saw bookings surpass the 2019 levels by 4%.

The company, which is known for its popular summer package holidays, increased its actual selling price (ASP) by 18%, as compared to 2019 levels. This helped the company to offset higher cost pressures.

Among its divisions, hotels and resorts will be delivering positive numbers for the fifth time in a row.

Moving ahead, the company is focused on its winter programme and expects it to be successful in a similar manner to its summer programme. The company is already witnessing a strong travel demand for winter 2022–23; however, higher household costs could lead people to more affordable destinations.

Driven by solid top-line growth, the company has endorsed its full-year guidance numbers and is expecting positive earnings in the results.

What does TUI Group do?

TUI is the world’s largest travel company, owning everything from air fleets to travel agencies.

It has tour operators, travel agencies, online portals, hotels, and cruise lines at various holiday locations across the globe.

TUI stock forecast

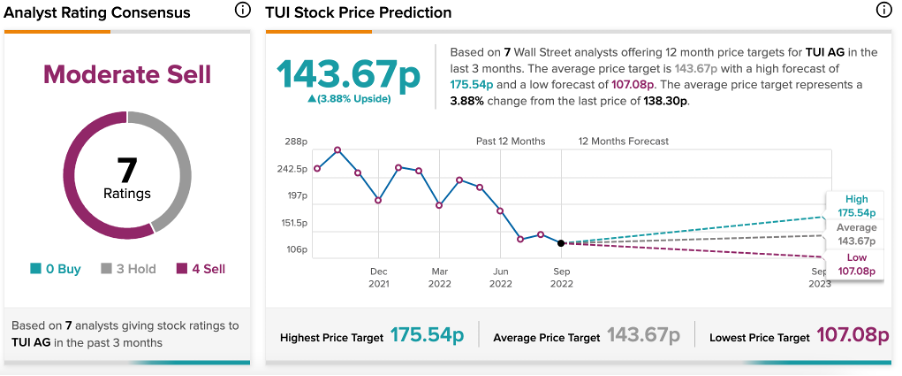

According to TipRanks, TUI stock has a Moderate Sell rating, based on three Hold and four Sell recommendations.

The TUI target price is 143.67p, which is around 4% higher than the current price level. The highest forecast for the target price is 175.54p.

Conclusion

The company is back to a period of higher demands, more bookings, and packed holiday seasons. Airport disruptions have also decreased in the fourth quarter, bringing back customer confidence.