Shares of Hims & Hers Health (HIMS) rallied in pre-market hours on Tuesday after management said it’s in discussions with Novo Nordisk (NVO) to offer oral Wegovy and Wegovy injections through its platform. Investors cheered the news as a strategic push into the booming weight-loss drug market, overshadowing Hims & Hers’ mixed Q3 2025 results. HIMS stock is up by 5.65% in pre-market trading on Tuesday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, Hims & Hers Health provides accessible healthcare products and services, including prescription medications, wellness products, and online medical consultations. The company posted EPS of $0.06, which was below the expected $0.10, while revenue of $599 million exceeded the analyst forecast of $580 million.

Hims to Bring Wegovy to Its Platform

Alongside its results, Hims & Hers stated that it remains in active discussions with Novo Nordisk, noting that no definitive agreement has been reached. The talks involve making Novo Nordisk’s oral Wegovy, after it is FDA-approved, available through the Hims & Hers platform.

The company further cautioned that there is no assurance an agreement will be finalized, and if one is, its terms may differ from current expectations.

Back in June, Novo Nordisk abruptly ended a month-long collaboration with Hims to sell Wegovy on the telehealth company’s platform over concerns about patient safety.

What’s Driving Investor Optimism?

Investors are optimistic, as a potential partnership with Novo could give Hims access to Wegovy, one of the most popular weight-loss drugs. The move would expand Hims’ reach in the booming obesity drug market and strengthen its position in telehealth.

Andrew Dudum, co-founder and CEO of Hims & Hers, stated that the company is “excited to re-engage with Novo around the oral pill that’s hopefully nearing FDA approval, as well as the commercial dosing.”

Meanwhile, Ethan Feller, a stock strategist at Zacks Investment Research, said that potential partnership talks “clear months of uncertainty around the collaboration and open a clearer path for Hims’ weight-loss vertical, one of the company’s key growth drivers.”

Is HIMS Stock a Good Buy?

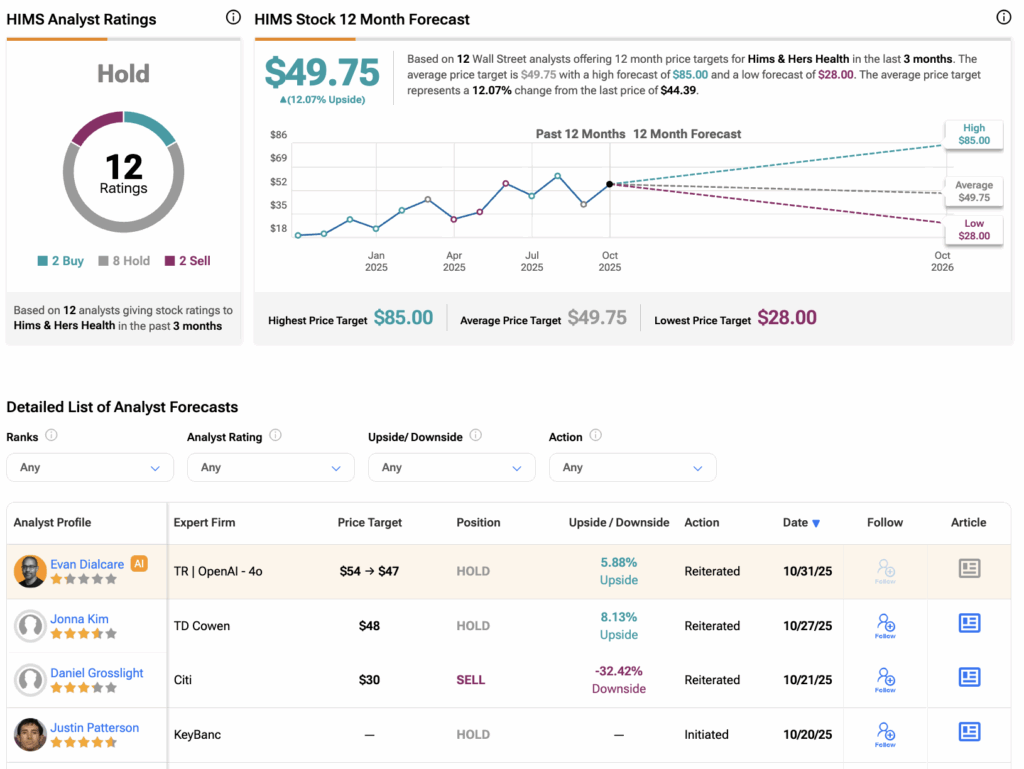

Overall, Wall Street analysts have a Hold consensus rating on HIMS stock based on two Buys, eight Holds, and two Sells assigned in the last three months. The average HIMS stock price target of $49.75 implies an upside of 12% from the current trading level.