Telehealth company Hims & Hers (HIMS) has reported mixed financial results for what was this year’s third quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The San Francisco-based company, which sells medications and personal care products, announced earnings per share (EPS) of $0.06, which fell short of the $0.10 expected on Wall Street. However, revenue in the period of $599 million was ahead of the $580 million consensus forecast of analysts.

The company attributed the revenue beat to the growth of subscribers on its platform as it continues to expand its personalized healthcare offerings. Hims and Hers Health said that its subscriber base increased to 2.47 million users, up 21% from a year earlier, while monthly online revenue per average subscriber increased 19% to $80.

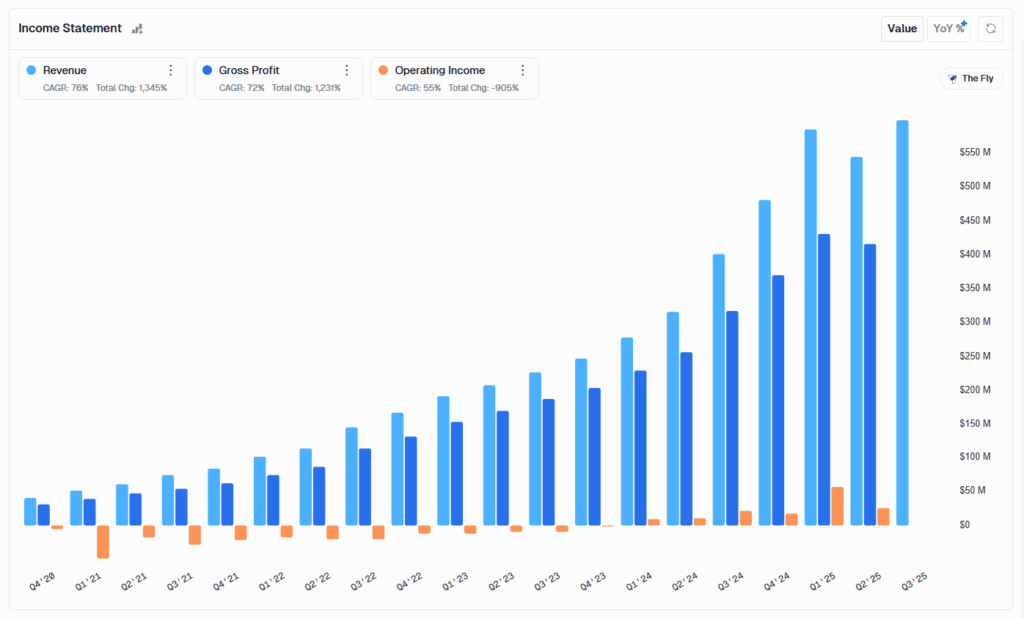

Hims and Hers Health’s income statement. Source: Main Street Data

Outlook

HIMS stock has skyrocketed this year as the company offered copied versions of semaglutide, the active ingredient in weight-loss drug Wegovy. However, there have been efforts to crack down on the practice, which has led to volatility in the stock.

In terms of guidance, Hims and Hers Health said that it expects revenue in the current fourth quarter of $605 million to $625 million. The consensus among analysts called for $629.6 million in Q4 sales. Management also projects full-year 2025 revenue of $2.34 billion to $2.36 billion, compared with analysts who expect $2.34 billion in sales for the entire year.

HIMS stock was up 7% immediately after the company issued its third-quarter financial results.

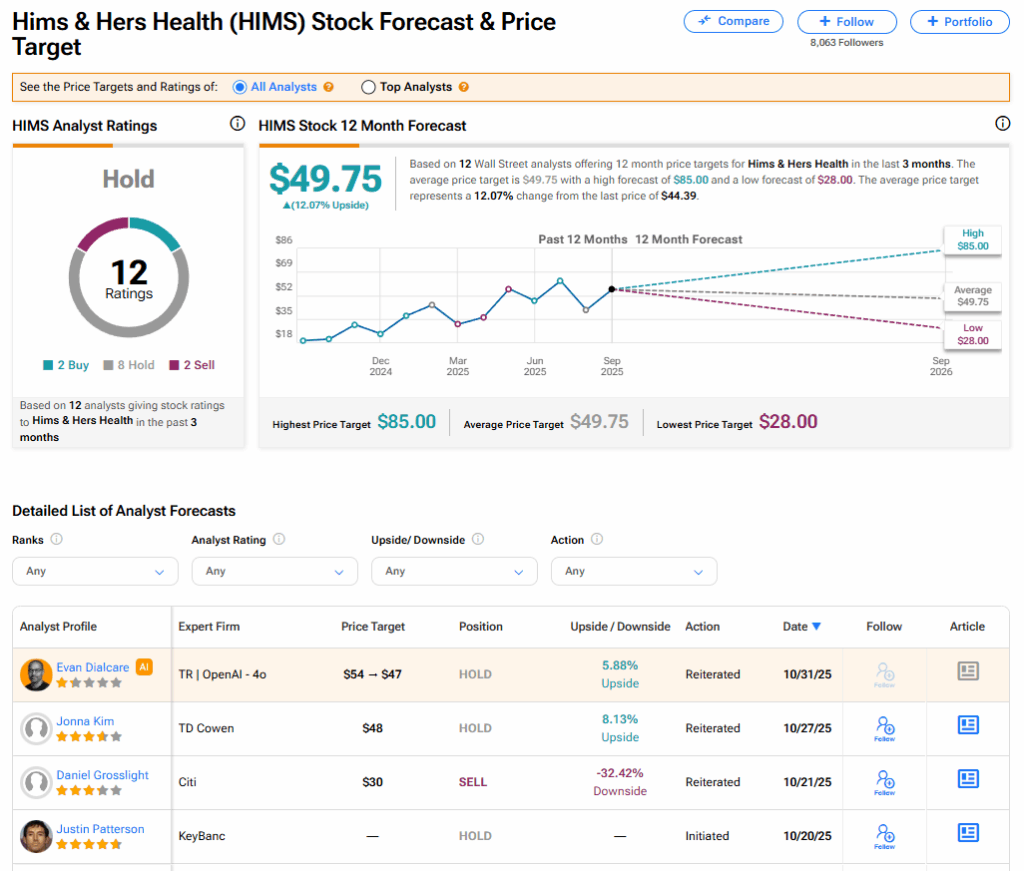

Is HIMS Stock a Buy?

The stock of Hims and Hers Health has a consensus Hold rating among 12 Wall Street analysts. That rating is based on two Buy, eight Hold, and two Sell recommendations issued in the last three months. The average HIMS price target of 49.75 implies 12.07% upside from current levels. These ratings could change after the company’s financial results.