HighPeak Energy, Inc. (NASDAQ: HPK) has reported mixed results for the fourth quarter of 2021. Its earnings lagged the consensus estimate by 10.3%, while the sales surpassed the same by 16%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Shares of this energy company changed slightly in the after-hours trading on Monday to close at $23.50. Interestingly, the shares rose 6.8% in the normal trading hours on Monday.

HighPeak Energy is an oil and gas exploration and production company. It has reserves of oil, natural gas liquids (NGL), and natural gas in West Texas’ Midland basin. The company is headquartered in Fort Worth, TX.

Quarterly Highlights

In the reported quarter, HighPeak Energy’s earnings came in at $0.35 per share, reflecting an improvement over the loss of $0.05 per share reported in the year-ago quarter. An increase in revenues supported the upside in earnings, while a hike in operating costs and expenses proved spoilsports. The quarterly earnings lagged the consensus estimate of $0.39 per share.

Revenues generated stood at $98.7 million, reflecting an increase from $11.6 million in the year-ago quarter. Also, the top line exceeded the Street estimate of $85.1 million. While crude oil sales expanded 737.5% year-over-year to $93.8 million, sales of natural gas rose to $4.9 million from $0.4 million in the year-ago quarter.

The company’s total sales volume stood at 1,369 thousand barrels of crude oil equivalent (MBoe), up from 306.6 MBoe in the year-ago quarter. The improvement was driven by volume increase for crude oil, NGL, and natural gas. Daily sales volume was 14,881 Boe per day (Boepd) in the quarter.

Total operating costs and expenses grew 148.7% year-over-year to $45.7 million.

Annual Highlights

In 2021, the company’s earnings were $0.54 per share, up compared with the loss of $0.18 per share in the previous year. Revenues were $220.1 million, up 794% from the previous year.

Exiting the year, the company’s cash and cash equivalents increased 78.3% year-over-year to $34.9 million. Its long-term debts (net of current maturities) stood at $97.9 million. Cash flow generated from operations totaled $147 million in 2021 and capital expenditures were $236.2 million.

The company’s proved reserves were 64.2 million barrels of crude oil equivalent (MMBoe), up 185 year-over-year. It consisted of 8% natural gas, 11% NGL, and 81% crude oil.

Management’s Comments

HighPeak Energy’s Chairman and CEO, Jack Hightower, said, “HighPeak is uniquely poised to take advantage of current market conditions because of our exception well economics, operational success and strong balance sheet. We are contemplating accelerating our drilling activity in this year’s business which we can accomplish without increasing our near-term outspend. We are a growth company and we want our shareholders to realize that we will lean into all available opportunities, especially given our quick payouts and high returns on investment.”

Projections for 2022

HighPeak Energy anticipates operating at least four drilling rigs in 2022. It added one drilling rig in October 2021 and one in January 2022.

The company expects the average production rate to be 27,000-32,500 Boepd and the exit production rate to be within 40,000-45,000 Boepd. Capital expenditure is predicted to be $750-$800 million. The company’s capital plan is subject to the impacts of the pandemic and the Ukraine-Russia war.

Capital Deployment

In 2021, HighPeak Energy repaid debts under a revolving credit facility of $20 million and distributed dividends totaling $11.6 million.

In February 2022, the company distributed dividends totaling $2.4 million (or $0.025 per share) to shareholders.

Analysts’ Take

Nick Pope, an analyst at Seaport Global Securities, recently maintained a Buy rating on HighPeak Energy and increased the price target to $22 (6.34% downside potential) from $19.

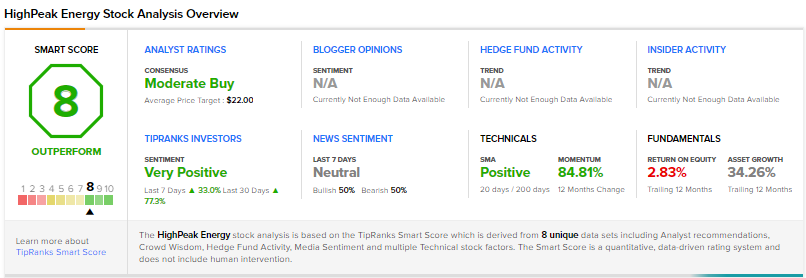

HighPeak Energy has a Moderate Buy consensus rating, reflecting analysts’ cautiously optimistic view. The average HighPeak Energy price target of $22 suggests a 6.3% downside risk from current levels. Over the past year, shares of HighPeak Energy have surged 187.2%.

Smart Score

According to TipRanks’ Smart Score rating system, HighPeak Energy gets an eight out of 10, which indicates that the stock has the potential to outperform market expectations.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Cargojet Swings to Profit in Q4

bluebird bio Reports Quarterly Loss, Provides Clinical Updates

Hibbett Misses Q4 Expectations; Shares Slip 5%