Shares of VinFast Auto (NASDAQ:VFS) continue to pop up on investors’ radars as the Vietnamese electric vehicle maker maintains its rapid pace of new product introductions and global expansion.

The company plans to set up a $2 billion production facility in India with an anticipated capacity of up to 150,000 vehicles annually. It has also announced plans for production plants in the U.S. and Indonesia. The EV maker aims to sell its vehicles in 50 markets by the end of this year. Further, VFS’ battery electric vehicle (BEV) assembly facility in Indonesia is expected to supply vehicles to Thailand, Singapore, Malaysia, and Australia.

On top of these factors, two critical moves could influence the trajectory for VFS shares. First, the company aims to increase its free float from nearly 2% to 10-20% by the end of this year. This move is aimed at lowering the volatility in VFS shares, a key characteristic of the stock since its debut in 2023.

Second, VFS is bringing the VF3 into the U.S. market, a vehicle with a price tag of only $20,000. Interestingly, the move comes after VFS received positive commentary from its U.S. dealers about the potential of targeting the lower end of the market.

Is VFS a Good Stock to Buy?

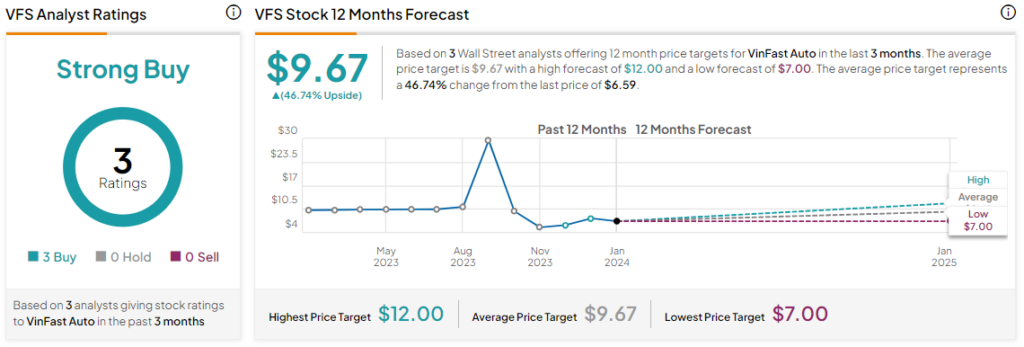

Overall, the Street has a Strong Buy consensus rating on VinFast, and the average VFS price target of $9.67 implies a substantial 46.7% potential upside in the stock. That’s after a nearly 21% slide in the company’s share price so far this year.

Read full Disclosure