Shares of retail coffee giant Starbucks (SBUX) are trending lower after a top Wall Street analyst downgraded the stock.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Andrew Charles, a top five-star rated analyst at TD Cowen, downgraded Starbucks stock to Hold from Buy while maintaining a $90 price target on the shares. In a note to clients, Charles acknowledged the potential for CEO Brian Niccol, who previously led Chipotle Mexican Grill (CMG), to turn the coffee chain around after years of underperformance.

However, the analyst also wrote that the market could be overlooking ongoing challenges facing Starbucks such as higher labor costs, weak consumer spending, and increasing competition within the retail coffee industry. As such, the TD Cowen analyst felt that SBUX stock was worthy of a downgrade.

Poor Perceptions

In his assessment, Charles also noted that Starbucks underperforms during periods of economic turmoil, and that consumer perceptions of the brand have deteriorated since the Covid-19 pandemic, with the company losing ground on metrics such as value and quality. This has led consumers to visit Starbucks less frequently.

Looking ahead, Charles expects Starbucks’ North American same-store sales growth to come in at an annual average of 3.5% between 2026 and 2028, below the consensus forecast on Wall Street of 4%. He also thinks Starbucks CEO Niccol’s turnaround plans will require higher operating expenses than Wall Street is currently pricing in.

“In our view, the company is still settling into a new base of earnings that differs from consensus,” wrote Charles. SBUX stock has declined 6% this year.

Is SBUX Stock a Buy?

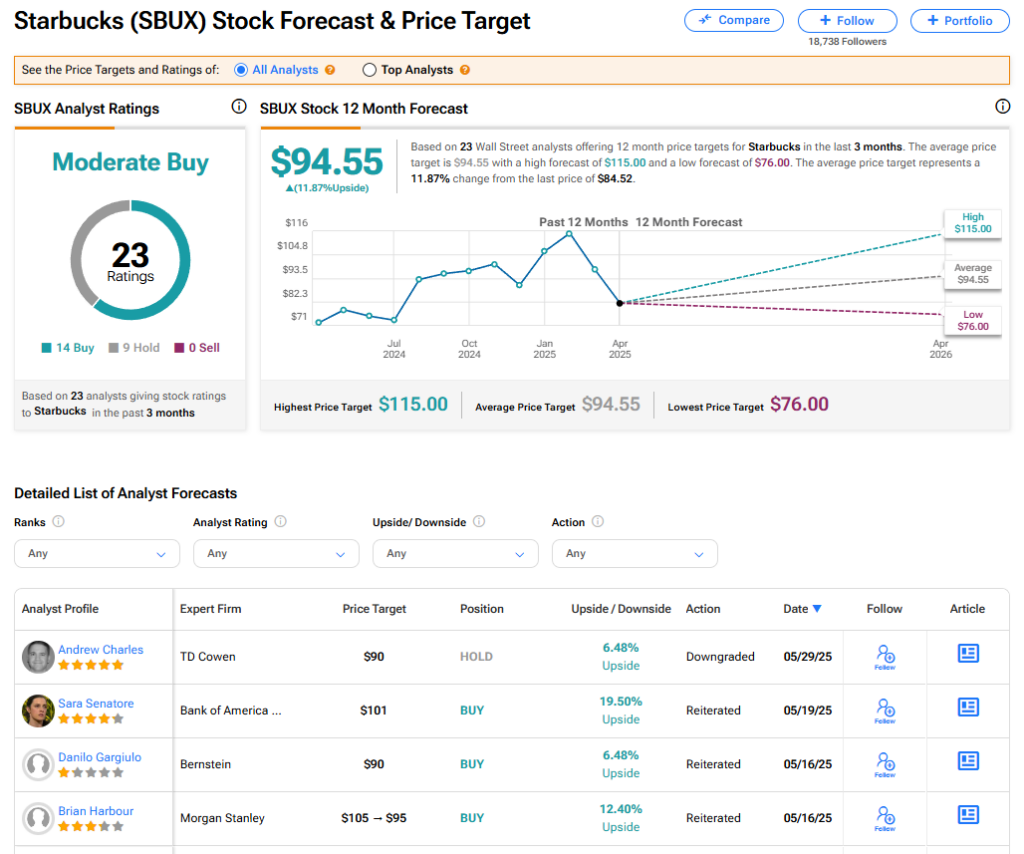

Starbucks’ stock has a consensus Moderate Buy rating among 23 Wall Street analysts. That rating is based on 14 Buy and nine Hold recommendations issued in the last three months. The average SBUX price target of $94.55 implies 11.87% upside from current levels.

Read more analyst ratings on SBUX stock

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue