Shares of SolarEdge Technologies (NASDAQ:SEDG) fell over 21% in Thursday’s after-hours following the company’s preliminary Q3 financial numbers that came well below management’s previous outlook. SEDG’s CEO, Zvi Lando, said that the company experienced “substantial unexpected cancellations and pushouts of existing backlog” from the European distributors, which weighed on its financials. SEDG will release its third-quarter earnings on November 1.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

SEDG’s Disappointing Q3 Update

Management blamed higher inventory and lower installations for the cancellations and pushouts. Consequently, SolarEdge anticipates third-quarter revenue to fall within the $720 million to $730 million range, much lower than its previous guidance of $880 million to $920 million.

The decline in sales is expected to adversely impact the company’s profit margins. SolarEdge now projects its adjusted gross margin in the range of 20.1% to 21.1%, a substantial decrease from its earlier forecast of 28% to 31%. Additionally, the company foresees a significant reduction in its adjusted operating income. SEDG now expects its adjusted operating income in the range of $12 million to $31 million, reflecting a considerable decline from the previous projection of $115 million to $135 million.

Following the weak preliminary Q3 financial numbers, Deutsche Bank analyst Corinne Blanchard downgraded SolarEdge stock to Hold from Buy. Moreover, the analyst slashed the price target to $150 from $300. The analyst expects residential demand to remain low in the U.S. and Europe. Also, higher inventory, pricing pressure, and heightened competition could pose challenges. With this backdrop, let’s look at what the Street recommends for SEDG stock.

Is SolarEdge a Buy or Sell?

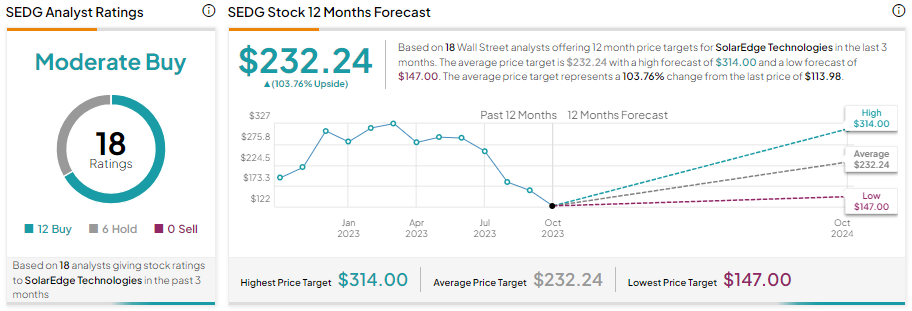

SolarEdge stock has a Moderate Buy consensus rating based on 12 Buys and six Hold recommendations. However, it’s important to note that the majority of these recommendations were issued before the company’s preliminary result announcement. Thus, there is a possibility of additional downgrades or adjustments to analysts’ price targets.

Nonetheless, the stock currently has an average price target of $232.24, implying 103.76% upside potential from current levels.