Shares of PayPal Holdings, Inc. (NASDAQ: PYPL) closed 12.2% up on Wednesday on the news that New York-based investment management firm and activist investor Elliott Management Corp. has a stake in the fintech company, The Wall Street Journal reported, citing people with knowledge of the matter.

However, it is not yet known what percentage of stake Elliott holds in PayPal. With a market cap of over $89 billion, the California-based company has around $8 billion of cash, short-term investments, and hardly any debt.

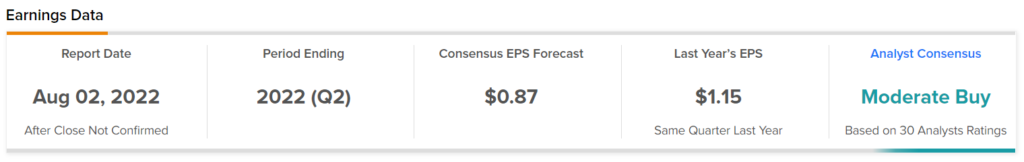

PayPal is scheduled to release its second-quarter results next week. The Street anticipates earnings to come in at $0.87 per share, lower than the year-ago figure of $1.15 per share but higher than the company’s projection of $0.86 per share. For the second quarter, PayPal expects annual net revenue growth of around 9%.

Analysts Are Cautiously Optimistic about PayPal

Last week, James Faucette of Morgan Stanley (NYSE: MS) reiterated a Buy rating on the stock with a $129 price target (49.3% upside potential).

Faucette said, “We think E-commerce growth probably needs to normalize before investors can turn positive on PYPL.”

Additionally, Darrin Peller of Wolfe Research downgraded PayPal from Buy to Hold and did not provide a price target.

Peller said, “The PayPal downgrade is due to the company having among the highest recession sensitivities as well as valuation.”

Overall, the stock has a Moderate Buy consensus rating based on 23 Buys, six Holds, and one Sell. PYPL’s average price target of $109.88 implies 27.2% upside potential.

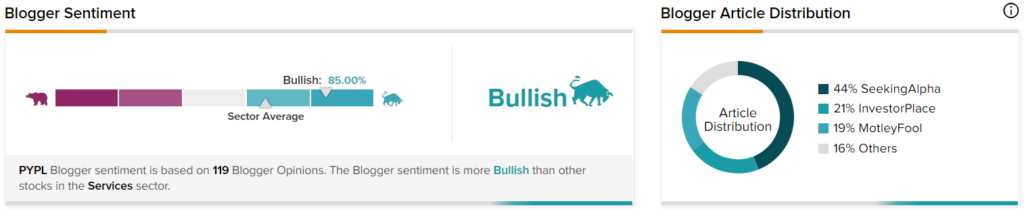

Bloggers Are Bullish on PayPal

TipRanks data shows that financial bloggers are 85% Bullish on PYPL, compared to the sector average of 66%.

Investors Hope for a Strong Quarter Ahead

PYPL stock, which has seen unprecedented growth over the past two years, has declined more than 55% so far this year. The company felt the impact of the lifting of COVID-19 restrictions with a decline in its first-quarter profits. PayPal reported a fall in its profit for the first time in the last two years. Investors are hopeful that it was just a one-off event and that the company should be able to post a profitable second quarter.

Read full Disclosure