Oracle (ORCL) stock gained 3% on Thursday after the database software and cloud infrastructure company announced a solid financial outlook during the AI World 2025 event and stated that its AI cloud server-rental business has a 35% gross margin over a contract’s life, addressing concerns about lower profitability following a report by The Information. However, ORCL stock was down 2.4% in Friday’s pre-market trading after declining in Thursday’s extended trading session, with Stifel analyst Brad Reback noting that the company’s Fiscal 2026 and 2027 earnings per share (EPS) targets slightly lagged the Street’s expectations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Interestingly, Oracle raised its Fiscal 2030 Oracle Cloud Infrastructure (OCI) revenue outlook to $166 billion and stated that its remaining performance obligations (RPO) now exceed $500 billion (up from $455 billion as of the previous quarter), as customer demand outstrips supply. Moreover, the company confirmed a cloud computing deal with social media giant Meta Platforms (META).

Stifel Analyst Weighs in on Oracle’s Financial Targets

Reback reiterated a Buy rating on Oracle stock with a price target of $350. The analyst highlighted that the company held an “upbeat” analyst meeting as part of its AI World user conference and raised its FY30 OCI revenue target. The analyst also noted the strength in the company’s RPO.

That said, Reback highlighted that Oracle stock fell in Thursday’s extended trading session as its Fiscal 2026 and Fiscal 2027 EPS targets of $8.00 and $10.65, respectively, were modestly below the Street’s expectations, as the company absorbs up-front scaling costs.

Looking ahead, Reback believes that Oracle will likely consolidate recent gains in the coming quarters, as investors digest the recent news flow and gain comfort with management’s ability to generate strong operating income growth.

Oppenheimer Analyst Remains on the Sidelines

While several analysts reaffirmed their Buy ratings and boosted their price targets for Oracle stock, Oppenheimer analyst Brian Schwartz reiterated a Hold rating. The analyst noted positive revisions to RPO, OCI, the medium-term financial outlook, and strong commentary on Oracle’s opportunity in the AI era.

He also highlighted enhanced transparency on the gross margin for OCI and AI consumption businesses. “The effective 30% to 40% gross margin for the latter refutes a bear case on AI profitability, and new disclosures of multiple mega AI deals in the current quarter, including with Meta, dent customer concentration concerns,” said Schwartz.

Despite Thursday’s event strengthening Schwartz’s confidence in Oracle’s ability to be one of the “fastest top- and bottom-line growers” in large-cap technology, he prefers to be on the sidelines only due to valuation concerns.

Is Oracle Stock a Buy, Sell, or Hold?

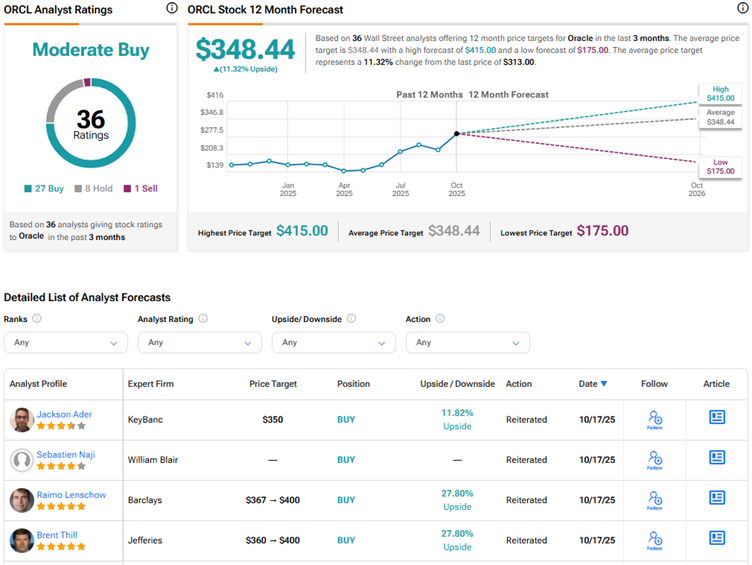

Overall, Wall Street has a Moderate Buy consensus rating on Oracle stock based on 27 Buys, eight Holds, and one Sell recommendation. The average ORCL stock price target of $348.44 indicates 11.3% upside potential.