Oracle (ORCL) stock gained about 5% after revealing a new financial outlook for its fast-growing AI infrastructure business. During its Financial Analyst Meeting at CloudWorld 2025, co-CEO Clay Magouyrk projected that the Oracle Cloud Infrastructure (OCI) unit could generate $166 billion in revenue by Fiscal 2030. This is much higher than $144 billion the company expected last month.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company also laid out other long-term goals, projecting $225 billion in annual revenue by Fiscal 2030, well above the $198 billion average analyst estimate. Even more, the company expects $21 per share in adjusted profit by that year, compared to the current consensus of $18.50.

Further, the company’s executives addressed investor concerns about its gross margins that were raised after a report from The Information had indicated Oracle’s AI cloud GPU rentals were only in the mid-teens percentage range.

As an illustration, the company cited a six-year, $60 billion AI infrastructure project that would achieve a gross margin of 35%.

Big AI Bets with Big Names

The forecast reflects Oracle’s push into the AI infrastructure space, where it is competing with giants such as Amazon’s (AMZN) AWS and Microsoft Azure (MSFT). The company’s cloud unit has already become one of its fastest-growing segments, reporting 50% year-over-year growth in 2025.

In recent months, Oracle has secured major contracts to build AI data centers for high-profile clients. The most notable deal is with OpenAI (PC:OPAIQ) to build five new data centers. But the company’s momentum goes well beyond a single customer.

“I know some people are questioning, ‘Hey, is it just OpenAI?’ The reality is, we think OpenAI is a great customer, but we have many customers,” Magouyrk said.

He revealed that Oracle booked $65 billion in new cloud deals over 30 days last quarter, and none of it came from OpenAI. The CEO confirmed a $20 billion deal with Meta Platforms (META) being one of them.

Oracle has also joined forces with Nvidia (NVDA) and AMD (AMD) to boost its AI capabilities and strengthen its position in the cloud and AI race.

Is Oracle a Buy, Sell, or Hold?

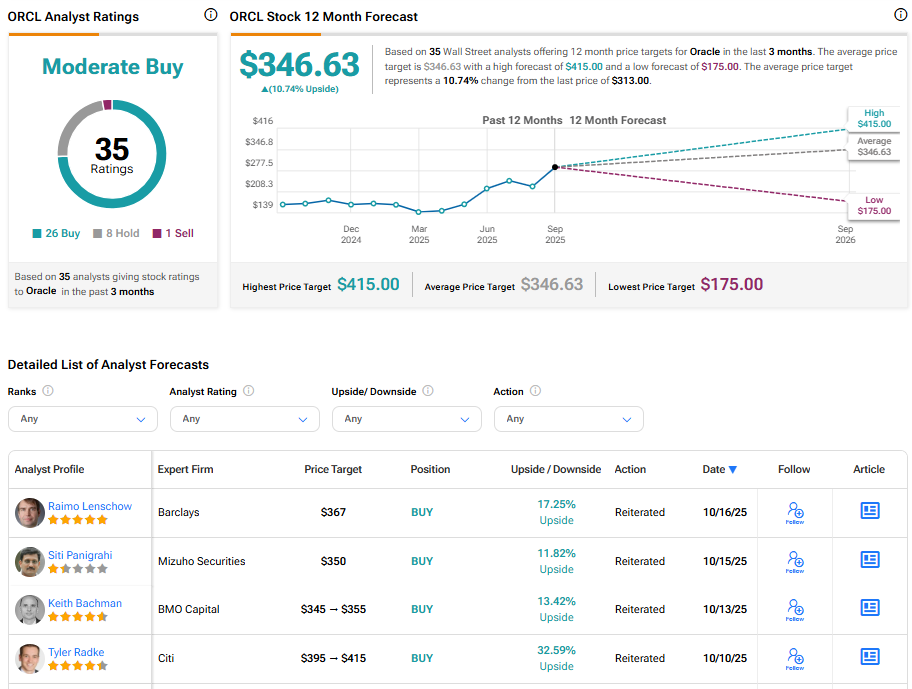

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ORCL stock based on 26 Buys, eight Holds, and one Sell assigned in the past three months. Further, the average Oracle price target of $346.63 per share implies 10.74% upside potential.