Shares of streaming giant Netflix (NASDAQ:NFLX) fell 5.2% in yesterday’s trading after CFO Spencer Neumann made some disappointing revelations about certain key aspects. At the Bank of America (NYSE:BAC) conference held on September 13 in New York, Neumann outlined several factors impacting the company’s current performance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The CFO noted that the ongoing Hollywood actors and writers strike is showing no signs of easing. Further, the strike is hurting production and compressing margins. He added that neither of the two unions that are on strike were in talks with the Alliance Motion Picture or Television Producers. New contract terms presented to the striking writers did not win their approval. As such, Neumann does not see the strikes ending soon.

Neumann Sees Lower Ad Revenues

The CFO guided operating margins to fall from 18% to 20%, while analysts projected a 19.8% margin. However, in the long run, beyond 2024, margins are expected to improve.

Turning to Netflix’s advertising business, Neumann cautioned that the ad-tiered plans are not doing as well as expected. Following Netflix’s password-sharing crackdown, most customers turned towards ad-free streaming, which does not bode well for a company trying to build a fortress from advertising revenues.

Building an “ad business from scratch is not easy,” Neumann said. Netflix’s major competitors in the advertising space are media house Walt Disney (NYSE:DIS) and tech biggie Apple (NASDAQ:AAPL).

He added that 90% of growth was coming from outside the U.S., which impacts the average revenue per user as Netflix’s international plans are relatively cheaper.

Talking about live sports streaming, Neumann said that Netflix will not be investing any big dollars in this segment since it is not profitable. He does not see any immediate and meaningful return on investment in live sports.

What is the Future of Netflix Stock?

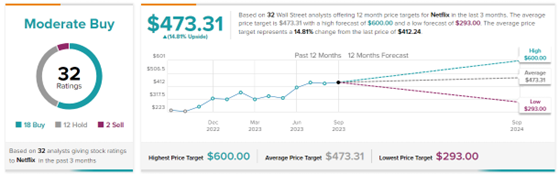

Following the CFO’s comments, Pivotal Research analyst Jeffrey Wlodarczak reiterated a Buy rating on NFLX stock with a price target of $600 (45.5% upside). Wlodarczak reduced the average revenue per user growth estimate to 2% from the earlier expectation of 4%. Additionally, the analyst reduced his Q4 revenue estimate to $8.73 billion from $8.89 billion.

Wall Street remains cautiously optimistic about Netflix stock. On TipRanks, Netflix has a Moderate Buy consensus rating based on 18 Buys, 12 Holds, and two Sells. Also, the average Netflix price forecast of $473.31 implies 14.8% upside potential from current levels. Meanwhile, NFLX stock has gained 39.8% so far this year.