On Monday, Morgan Stanley increased the price target for SoFi Technologies (SOFI) stock to $18 from $13, citing an improvement in its view of the North America consumer finance group to “In-Line” from “Cautious.” SOFI stock has risen more than 7% over the past month and more than 78% year-to-date, thanks to the fintech and digital bank’s impressive financials, a rapidly growing member base, and strong execution.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Morgan Stanley’s Take on SOFI and the Consumer Finance Group

Morgan Stanley analyst Jeffrey Adelson noted that interest rates are moving lower, and the North America consumer finance group’s near-term credit performance continues to improve.

Adelson added that this improvement is happening despite slower hiring, which reduces downside risks for the stocks in the group. The analyst raised the price targets for SOFI and other companies in the consumer finance sector as he rolled forward models to 2027.

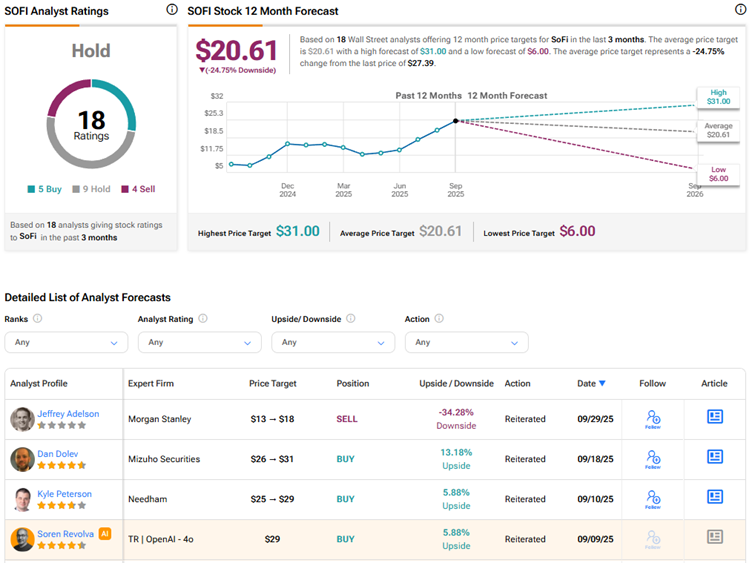

While Adelson increased his price target for SOFI stock, he reiterated a Sell rating. Adelson and several other Wall Street analysts are sidelined or bearish on SOFI due to valuation concerns, as they believe that the optimism about the company’s growth potential is already priced into the stock.

In contrast, SOFI bulls remain confident about the company’s ability to deliver continued growth. Recently, Mizuho analyst Dan Dolev increased his price target for SoFi Technologies stock to $31 from $26 and reaffirmed a Buy rating. Dolev’s analysis indicates that bank processors, consumer lenders, and exchanges are best positioned to benefit from interest rate cuts. In particular, the top-rated analyst believes that SoFi’s “strong rate-driven outlook” commands a higher valuation multiple.

Is SOFI Stock a Good Buy?

Overall, Wall Street has a Hold consensus rating on SoFi Technologies stock based on five Buys, nine Holds, and four Sell recommendations. The average SOFI stock price target of $20.61 indicates a 25% downside risk.