Nuclear energy start-up Oklo (OKLO) on Monday held a high-profile event to mark the start of the construction of its first Aurora powerhouse. However, investment banking giant Goldman Sachs (GS) on Thursday kicked off its stock coverage of OKLO stock with a price target suggesting an 11% downside risk.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The powerhouse, which is a small modular reactor designed to deliver clean and affordable energy, is being built at the site of the Idaho National Laboratory, which is the site of the American government’s center for nuclear energy research and development. The event marked a key milestone for Oklo, which has not yet turned a profit but is looking to deliver its first nuclear power plant by 2028.

Oklo Rides the Nuclear Energy Wave

Oklo has been riding the nuclear energy hype, even as President Donald Trump earlier in the year signed four executive orders targeted at “reinvigorating” America’s nuclear industry. It also comes as U.S. tech giants have poured unprecedented amounts into energy-demanding AI data centers to power the AI era.

Furthermore, the US and UK’s new “technology prosperity deal” includes over $100 billion in nuclear technology investments expected to usher both countries into the “golden age of nuclear.” As a result of these, the nuclear energy market is now estimated to hit $10 trillion by 2050.

However, during trading hours on Thursday afternoon, Oklo’s stock was already down by almost 12% around 1:25 p.m. EDT.

Goldman Sachs Sees Downside Risks in Oklo

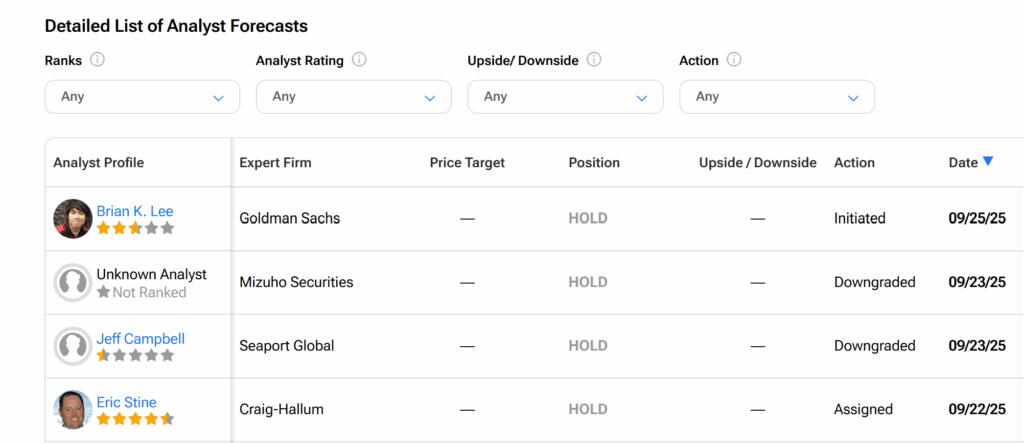

Meanwhile, while Wedbush analyst Daniel Ives sees Oklo gaining from these recent developments and raised his price target for the stock to a Street-high $150 per share, Goldman Sachs analyst Brian Lee initiated this coverage with a Neutral rating at a price target of $117.

According to Lee, while OKLO is making progress with its Aururao Powerhouse, with a commercialization deadline set for late 2027 or early 2028, the startup’s own-and-operate business model—despite affording it with more control—comes at “much greater financial risks”. This model is also exerting “considerable capital intensity” on the company, the analyst said.

Furthermore, Lee said Oklo’s technology is dependent on High-Assay Low Enriched Uranium (HALEU), a type of which has limited commercial availability. HALEU is renowned for its higher energy potential compared to standard fuel sources.

Nonetheless, despite these factors, Goldman Sachs expects several catalysts to continue to elevate Oklo’s valuation in the foreseeable future. Some of them include the company’s license from the U.S. Nuclear Regulatory Commission and its recent power purchasing agreement with data center developer Switch.

Is Oklo Inc. a Good Stock to Buy?

Across Wall Street, Oklo’s shares currently hold a Moderate Buy consensus recommendation, as seen on TipRanks. This is based on four Buys, three Holds, and one Sell assigned by eight Wall Street analysts over the past three months.

However, the average OKLO price target of $81.00 suggests a 31% change from the current level.