Oklo (NYSE:OKLO) stock has turned into a runaway juggernaut, and it shows no signs of hitting the brakes. Riding the wave of next-gen nuclear energy hype, the stock has been on an absolute tear, soaring an astonishing 1,617% over the past year, including a 94% surge this month.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Last Friday only added fuel to the fire. The SMR (small modular reactor) pure-play surged again after the U.S. and U.K. unveiled a major nuclear energy pact between the United States and the United Kingdom focused on speeding up the rollout of advanced reactors. The Atlantic Partnership for Advanced Nuclear Energy is a multi-billion-dollar program meant to push forward next-generation reactor development in both countries.

With major players such as Google, OpenAI, CoreWeave, and, most recently, Microsoft ramping up investments in UK data centers, the country is exploring alternative energy sources to power its rapidly expanding AI infrastructure.

Still, it should probably be noted that the deal doesn’t change the fact Oklo is a pre-revenue company with no reactors yet in operation. Nevertheless, Wedbush analyst Daniel Ives thinks that with the US and UK signing several nuclear deals, this is the beginning of a new era.

“The UK announced recent plans to slash the licensing timeline from 3-4 years to two years representing a massive acceleration for companies deploying SMRs including OKLO opening the door for nuclear energy names to enter the region to meet rising power needs to fuel its AI initiatives given the relatively small number of nuclear reactors built out,” the 5-star analyst explained.

But this development only adds more momentum to the story. With the Trump Administration’s recent executive order spotlighting nuclear energy, Ives sees this as “just the start” of a broader US push over the next year – one in which Oklo is poised to take a leading role. The analyst highlights recent meetings on Capitol Hill that reinforced his confidence momentum for nuclear is building in Washington, setting up Oklo to benefit from a “wave of spending/growth/ regulatory approval.”

Furthermore, being announced as an initial selection for the Nuclear Reactor Pilot Program shows how Oklo is a prime beneficiary of the US government’s accelerated push for nuclear energy. The company also announced a $1.68 billion plan to build a Tennessee fuel recycling facility, designed to convert spent fuel into fast reactor fuel for its Aurora powerhouse – creating a circular energy ecosystem to support rising AI demand. “Oklo continues to position itself to emerge as a strategic winner in this market to ensure the US remains the epicenter of advanced nuclear energy to power the AI Revolution,” Ives further said.

To this end, Ives boosted his price target from $80 to a Street-high $150. That technically implies only about 5% further upside from here – modest when stacked against the monster run the stock has already delivered. Still, paired with his continued Outperform (i.e., Buy) rating, the message is clear: Ives sees the story as intact, even if the easy money has already been made. (To watch Ives’ track record, click here)

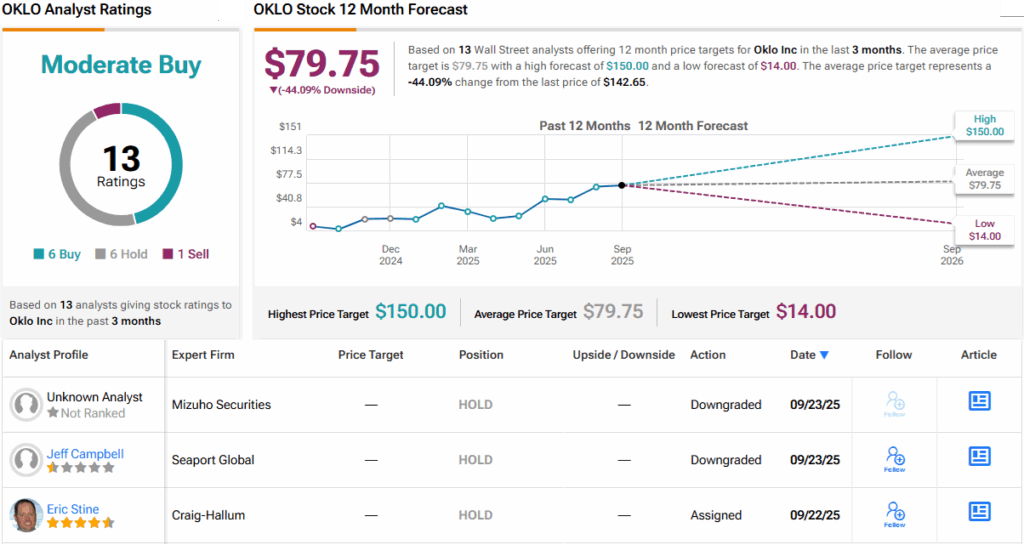

Still, Oklo has Wall Street scratching its head. The consensus view – 6 Buys, 4 Holds, and 1 Sell – lands at a Moderate Buy. Yet, the average price target sits at just $79.75, implying a steep 44% downside from current levels. Either analysts start chasing the stock higher with target hikes, or they throw in the towel with downgrades. One way or another, something’s got to give. (See OKLO stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.