Fate Therapeutics (NASDAQ:FATE) dropped more than 14% in yesterday’s trading session and also hit a new 52-week low of $14.84 during mid-day. The shares fell despite positive results from two of its ongoing Phase 1 trials and gave details about the treatment of acute myeloid leukemia (AML) at the recent annual meeting. Perhaps, the market may have been anticipating Fate Therapeutics to reveal Phase 2 trials for any of the 10 pipeline drugs.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Fate Therapeutics is a biopharmaceutical company dedicated to the development of programmed cellular immunotherapies for cancer and immune disorders.

The company is developing the treatment of AML in partnership with GT Biopharma (GTBP), which involves combining their platforms. The companies said this approach has the potential to “address the clinical heterogeneity of AML and enhance outcomes for patients with advanced disease.”

The company also presented data from the dose-escalation stage of its ongoing Phase 1 study of FT576 for patients with multiple myeloma and FT819 for patients with B-cell lymphoma. Both studies are said to show an encouraging safety profile.

Is FATE Stock a Buy?

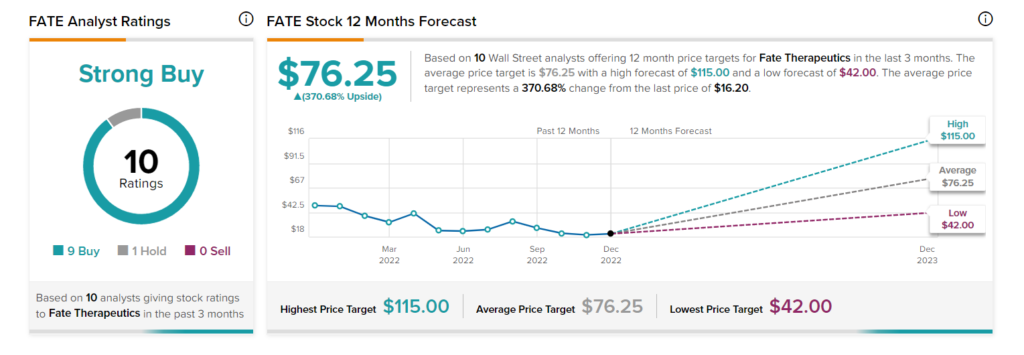

Turning to Wall Street, analysts are optimistic about Fate Therapeutics stock and have a Strong Buy consensus rating, which is based on nine Buys and one Hold. FATE’s average price target of $76.25 implies 370.7% upside potential. Year-to-date, the stock is down 73.1%.