AMC Entertainment (NYSE:AMC) stock declined more than 14% yesterday after the company disclosed a $250 million at-the-market (ATM) offering of its common stock. AMC aims to shore up its balance sheet with the stock sale. The move comes after the company’s first-quarter performance was impacted by weak box office revenues due to the strikes by Hollywood writers and actors in 2023.

The company seeks to use the proceeds from this sale to bolster liquidity position and repay debt, and for general corporate purposes.

It is worth mentioning that AMC completed a similar ATM offering in December 2023, raising about $350 million. As of December 31, 2023, AMC’s financial position reflected total debt (including finance leases) of $4.56 billion and cash reserves of $884.3 million.

Is AMC a Buy, Sell, or Hold?

Delays in film releases stemming from last year’s strikes are expected to dampen AMC’s performance in the near term. Additionally, AMC’s high debt levels and ongoing capital-raising activities continue to weigh on investor sentiment.

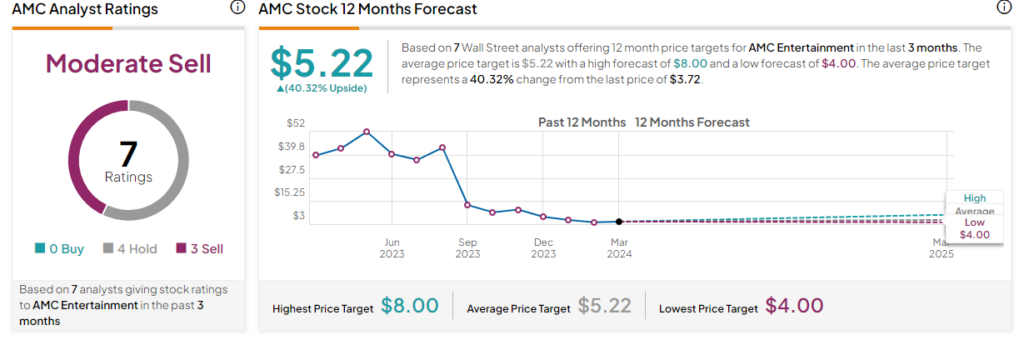

On TipRanks, AMC has a Moderate Sell consensus rating based on four Hold and three Sell ratings. The analysts’ average price target on AMC stock of $5.22 implies 40.3% upside potential. Shares of the company have declined about 53% in the past six months.