AMC Entertainment Holdings (NYSE:AMC) has agreed to settle a shareholder lawsuit concerning stock conversion. Following the news, shares of the movie theatre chain fell about 22% in yesterday’s extended trade, while AMC Preferred Equity Units (NYSE:APE) gained more than 22%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The lawsuit was filed by the Allegheny County Employees’ Retirement System in February. The system charged AMC with bypassing shareholders’ voting rights to increase the share count.

As part of the settlement, both parties to the lawsuit will ask the court to lift the status quo order to allow the conversion of APE units into AMC common stock. With the court’s approval, AMC will be able to increase its authorized share count to 550 million from 524 million and carry out a 1-to-10 reverse stock split.

The settlement is expected to give AMC another chance to enhance its business prospects. The company has been struggling with declining profits due to low attendance in movie theaters. Also, the stock conversion would help AMC reduce its massive debt load. On March 14, AMC shareholders voted in favor of the conversion.

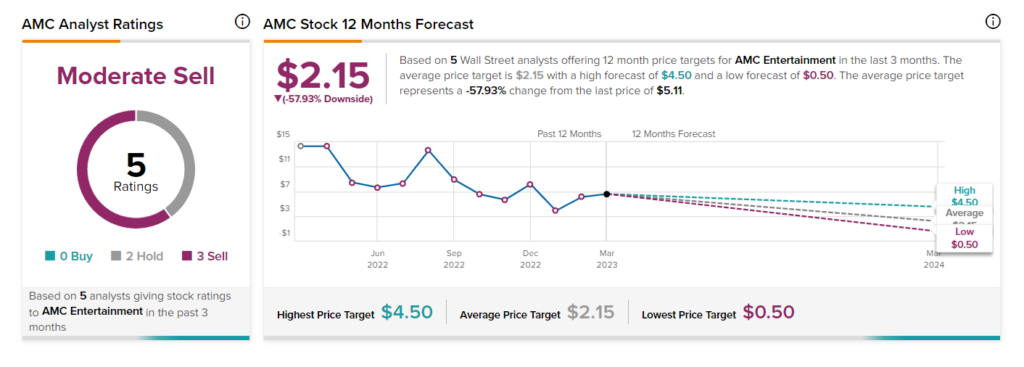

Is AMC a Buy, Sell, or Hold?

On TipRanks, AMC stock has a Moderate Sell consensus rating based on two Holds and three Sells. The average price target of $2.15 implies 57.9% downside potential.