Updated 1:10PM EST

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Investors are said to have approved management’s proposal for a 10-for-1 reverse stock split, allowing the company to convert its preferred shares into common stock, according to Bloomberg.

The only remaining hurdle for AMC is a class-action lawsuit that was filed by the Allegheny County Employees’ Retirement System, which is seeking an injunction to prevent the conversion from going through. The hearing is set for April 27.

First Published: 11:30AM EST

Shares of AMC Entertainment Holdings (NYSE:AMC) are lower today as shareholders are scheduled to vote on whether or not to convert AMC Preferred Equity Units (NYSE:APE) into common shares at noon. If this happens, then there will be another vote on a 10-for-1 reverse stock split. Investors will also be voting to increase the number of authorized shares AMC can issue.

AMC is looking for ways to continue paying down debt while trying to diversify its revenue stream. CEO Adam Aron believes that investors will benefit from voting yes to the proposed terms, as it would be much more dilutive in the long run if they oppose.

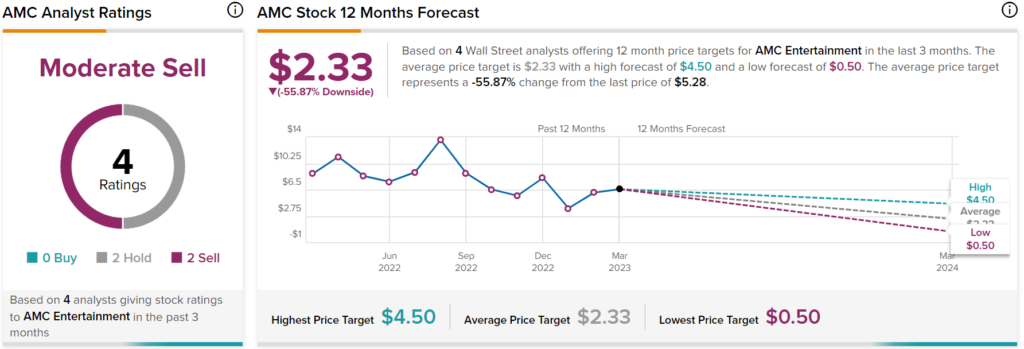

Overall, Wall Street analysts have a consensus price target of $2.33 on AMC stock, implying over 55% downside potential, as indicated by the graphic above.