Shares of Acadia Pharmaceuticals (NASDAQ:ACAD) have gained about 23% in yesterday’s extended trading session. The upside can be attributed to the expansion of the company’s agreement with Australia’s Neuren Pharmaceuticals (AU:NEU) for Rett syndrome treatment trofinetide, marketed by ACAD under the name Daybue in the U.S.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Under the newly agreed terms, Acadia has obtained the rights to market trofinetide outside North America. Furthermore, the deal grants Acadia global rights to Neuren’s new drug candidate, NNZ-2591, for the treatment of both Rett syndrome and Fragile X syndrome.

In exchange for these additional rights, ACAD has agreed to make an upfront payment of $100 million to Neuren. Also, Neuren is eligible to receive milestone and royalty payments earned separately for trofinetide and NNZ-2591. Moreover, Neuren will receive tiered royalties from the mid-teens to low-twenties percentage of net sales of trofinetide outside of North America.

Trofinetide to Drive Growth

The broader collaboration with Neuren allows Acadia to strengthen its position in the global market. ACAD aims to submit an application for regulatory approval of trofinetide in Canada within 18 months. Following this submission, the company intends to pursue regulatory approvals in other regions, including Europe and Asia.

It is worth highlighting that Daybue was the first treatment for Rett syndrome to be approved by the U.S. Food and Drug Administration in March. Interestingly, Acadia is optimistic about the growing demand for Daybue and its potential to contribute to the company’s performance. ACAD disclosed that it anticipates net sales in the second quarter of between $21 million and $23 million, rising to between $45 million and $55 million in the third quarter of 2023.

Alongside this, the company also provided updated sales guidance for its Parkinson’s disease drug, Nuplazid. ACAD expects the drug to witness net sales of $140 million to $144 million for Q2 and $530 million to $545 million for the full year 2023.

Is ACAD a Buy or Sell?

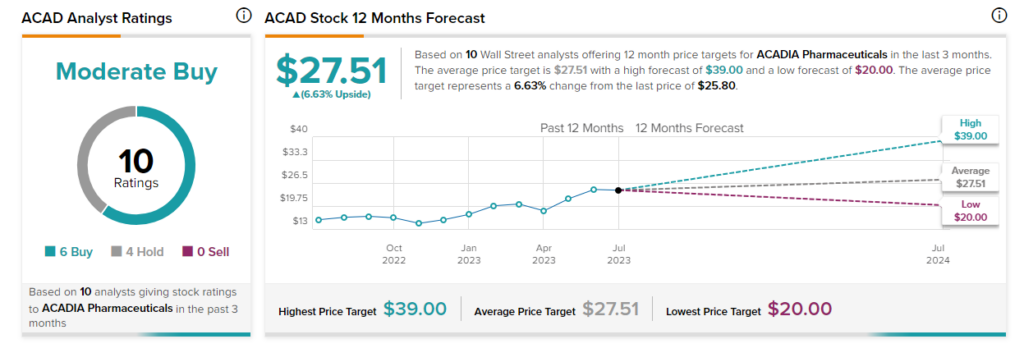

Following the news, JMP Securities analyst Jason Butler reiterated a Buy rating on the stock and raised the price target to $39. The analyst is optimistic about the latest deal’s impact on Acadia’s performance.

Overall, ACAD stock carries a Moderate Buy consensus rating on TipRanks. Meanwhile, the average ACAD stock price target of $27.51 reflects an upside potential of 6.63% from the current level.