Shares of 3M (MMM) gained almost 5% on July 26 to close at $140.75 despite reporting lackluster Q2 results and a trimmed FY22 outlook. Investors cheered the company’s plans to spin off its healthcare business and resolve the litigation concerns of its Combat Arms Earplugs.

Based in Minnesota, 3M Company manufactures and sells industrial, safety, and consumer products worldwide. It operates through various business segments, including Safety and Industrial, Transportation and Electronics, Health Care, and Consumer.

3M’s Q2 Numbers

Positively, adjusted earnings of $2.48 per share beat analysts’ expectations of $2.43 per share but were lower than the reported earnings of $2.75 per share for the prior-year period.

However, revenues declined 3% year-over-year to $8.7 billion and were slightly short of consensus estimates of $8.6 billion.

The top-line was negatively impacted by 4% due to the impact of foreign currency translation owing to the strength of the U.S. dollar. This was coupled with another 4% from the combined impact of China’s COVID-related lockdowns and reduced demand for disposable respirators.

3M to Spin Off Healthcare Business

3M announced that it will spin off its healthcare business into a separate public-listed company.

Upon completion, 3M will continue to remain a leading global material science company serving various industrial and consumer markets. Meanwhile, the standalone healthcare company will primarily focus on wound care, oral care, healthcare IT, biopharma filtration, and healthcare technology.

The tax-free transaction is expected to be completed by the end of 2023. 3M will retain a 19.9% stake in the new healthcare company, which is expected to be monetized over time.

The company also stated that its Aearo Technologies unit, which produces earplugs for the U.S. military, has voluntarily filed for bankruptcy protection. The unit has been accused in multiple lawsuits of defective designs and incorrect test results, leading to potential hearing damage.

3M Lowers Outlook Below Expectations

Based on the current uncertain macroeconomic scenario and currency headwinds due to the stronger dollar, management lowered financial guidance for the full-year FY2022 below analysts’ expectations.

The company now forecasts FY2022 sales to decline by 0.5% to 2.5% (versus the previously expected growth range of 1% to 4%). This is lower than the consensus estimate of 0.3%.

Further, the company now expects adjusted earnings in the range of $10.30 to $10.80 per share, lower than the prior guided range of $10.75 to $11.25 and the consensus estimate of $10.50 per share.

MMM CEO’s Comments

Sharing his views on the trimmed outlook, 3M CEO, Mike Roman, stated, “We updated our adjusted full-year expectations largely due to the strength of the U.S. dollar and uncertain macroeconomic environment.”

However, he added, “We remain focused on innovating for customers, driving operational improvements and advancing our environmental stewardship – while positioning 3M for the future through our plan to spin off our Health Care business and resolve Combat Arms litigation in a manner that is efficient and equitable.”

Wall Street’s Take on MMM

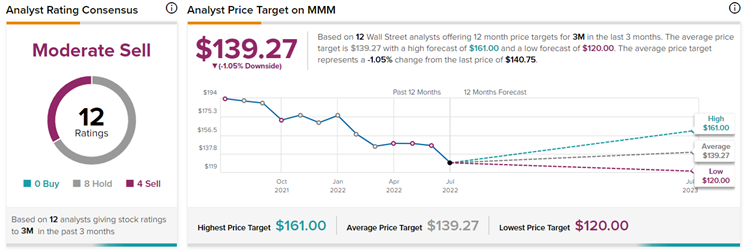

According to TipRanks’ analyst rating consensus, MMM is a Moderate Sell, based on eight Hold and four Sell ratings. The average MMM price target is $139.27, implying that the shares are fully valued at the current price levels.

Concluding Thoughts

3M has been working on a turnaround initiative for a long time and has made numerous efforts, including the recent sale of the Neoplast and Neobun brands, to focus on other crucial aspects of its business segments.

The healthcare spin-off will further streamline the company’s operations, putting attention on growth initiatives and boosting shareholders’ returns.