Constellation Brands, Inc. (NYSE: STZ), Micron Technology, Inc. (NASDAQ: MU) and Walgreens Boots Alliance, Inc. (NASDAQ: WBA), the large-cap companies with a market cap of over $30 billion and a Smart Score of 7 and 8 on TipRanks, are scheduled to release their quarterly earnings this week. Let’s look at what the Street has to say about them.

Constellation Brands

New York-based Constellation Brands produces and sells wine, beer and spirits in Italy, New Zealand, the U.S. and Mexico. Its beer brands include Pacifico, Modelo Negra, Modelo Especial and Corona. The company’s wine and spirits brands comprise High West Whiskey, Robert Mondavi, Casa Noble Tequila, Kim Crawford, Meiomi, SVEDKA Vodka and The Prisoner.

STZ is expected to announce its fiscal first-quarter results on June 30 before the market opens. For the quarter ended May 30, 2022, the Street anticipates the company to report earnings of $2.52 per share, compared to $2.33 per share in the first quarter of last year.

In the fiscal fourth quarter ended February 28, the company reported earnings of $2.37 per share.

On TipRanks, the stock has a Moderate Buy consensus rating based on 10 Buys and four Holds. STZ’s average price target of $272.14 implies almost 11% upside potential from current levels. Shares have grown 8.5% over the past year.

TipRanks data shows that financial bloggers are 81% Bullish on STZ, compared to the sector average of 68%.

Micron Technology

Based out of Idaho, Micron Technology manufactures and sells memory and storage solutions. Its offerings include USB flash drives, flash memory and random-access memory chips. Its brands include Crucial and Ballistix.

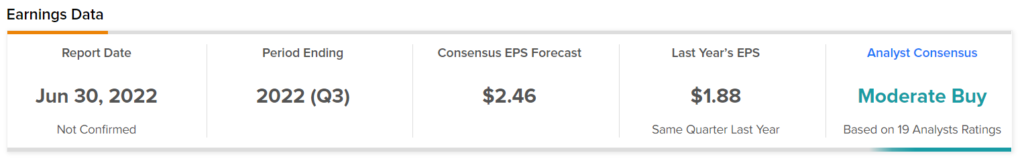

MU is also expected to release its fiscal third-quarter results on June 30. Analysts expect the company to report earnings of $2.46 per share, compared with $1.88 per share in the previous year and $2.14 in the second quarter.

Ahead of the results, Deutsche Bank (NYSE: DB) analyst Sidney Ho maintained a Buy rating on the stock but did not provide a price target. Ho expects Micron to report in-line third-quarter figures.

Additionally, Joseph Moore of Morgan Stanley (NYSE: MS) reiterated a Hold rating on MU and lowered the price target to $56 from $83 (4.2% downside potential).

Moore said, “While we appreciate the cost structure improvements and product roadmap at Micron, we are incrementally cautious around the end market outlook, and more specifically elevated inventory levels and related pressure on pricing which is trending down.”

Overall, the stock has a Moderate Buy consensus rating based on 14 Buys, four Holds and one Sell. MU’s average price target of $104.73 implies 79.2% upside potential from current levels. Shares have lost 38% over the past six months.

TipRanks’ Hedge Fund Trading Activity tool shows that the confidence in Micron is currently Very Negative, as the cumulative change in holdings across all 29 hedge funds that were active in the last quarter was a decrease of 3.1 million shares.

Walgreens Boots Alliance

Headquartered in Illinois, Walgreens Boots Alliance runs retail pharmacy chains Boots and Walgreens. Its other brands include Duane Reade, No7 Beauty Company, Benavides and Ahumada. The company also has investments in retail, pharmacy and healthcare segments.

WBA is slated to announce its third-quarter results on June 30 before the market opens. The consensus EPS forecast stands at $0.92, lower than the year-ago EPS of $1.38 and $1.59 in the second quarter.

Steve Valiquette of Barclays (NYSE: BCS) expects the company to post earnings of $0.88 per share in the third quarter. He believes investor focus will be on “the outlook for foot traffic and front-end inventory/supply chain risk.”

Valiquette has maintained a Hold rating on the stock and lowered the price target to $45 from $50 (8% upside potential).

Based on one Buy, eight Holds and one Sell, the stock has a Hold consensus rating. WBA’s average price target of $47.70 implies 14.5% upside potential from current levels. Shares have lost almost 17% over the past year.

Conclusion

As the aforementioned large-cap companies are scheduled to release their quarterly results on the same day (June 30), it would be interesting to observe their impact on the market.

Read full Disclosure