Axos Financial (NYSE:AX), the parent company of Axos Bank, is scheduled to report its results for the second quarter of Fiscal 2023 (ended December 31, 2022) after the stock markets close on January 26. Wall Street expects strong earnings growth in Q2 FY23, thanks to rising interest rates.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Fiscal Q2 Expectations

Axos’ adjusted EPS grew nearly 15% year-over-year to $1.18 in Q1 FY23, with net interest income rising 23% to $180.5 million. Higher interest rates coupled with strong loan growth fueled the increase in the net interest income. Derrick Walsh, Axos’ CFO ensured investors that the credit quality of the company’s loan portfolio continued to be healthy, with a non-performing loan ratio of 0.78%.

Analysts expect Axos’ Q2 FY23 GAAP EPS to grow 18% to $1.18. Meanwhile, the company’s adjusted EPS is projected to come in at $1.23 compared to $1.04 in the prior-year quarter.

Is AXOS a Buy?

Recently, Keefe Bruyette analyst Michael Perito opined that Axos Financial’s current valuation doesn’t reflect its “strong history” of compounding book value growth and the upside potential to consensus earnings estimates through the continued expansion of Axos Advisor Services. The analyst highlighted that Axos has a “manageable risk profile with a strong capital and liquidity position.”

Perito feels that Axos offers investors an attractive fundamental upside amid an uncertain macro environment in the first half of 2023. In line with his bullish thesis, Perito reiterated a Buy rating on AXOS stock with a price target of $54.

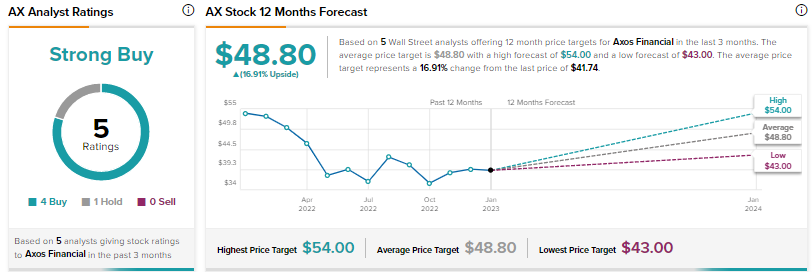

Wall Street’s Strong Buy consensus rating for Axos Financial is based on four Buys and one Hold. The average AX stock price target of $48.80 implies nearly 17% upside potential. Shares have advanced 9.3% year-to-date.

Conclusion

Axos Financial is expected to report strong earnings growth for the fiscal second quarter due to soaring interest rates. Investors would keenly watch management’s commentary about loan growth and credit quality, given a challenging macro backdrop.