HealthEquity reported better-than-expected third-quarter results and a mixed outlook for fiscal 2021. The health care company’s earnings of $0.41 per share came ahead of analysts’ estimates of $0.36 but declined 4.7% year-over-year. Its 3Q revenues of $179.4 million topped the Street’s estimates of $176.8 million and increased 14% from the year-ago quarter, despite a 40% decline in commuter revenue.

Meanwhile, HealthEquity’s (HQY) shares dropped 1.8% in Monday’s after-market trading session after closing 2.6% lower on the day.

The company reported total HSAs [health savings accounts] increased 9% year-over-year to about $5.5 million as of the end of Oct. 31. The company’s CEO Jon Kessler said, “Our team helped members open over 104,000 new HSAs this quarter, growing membership organically by 11% year-over-year, with HSA assets growing by more than $200 million, or 19% year-over-year. Total accounts held steady at 12.5 million despite 0.6 million commuter accounts being suspended as more participants began working from home due to COVID-19.”

As for fiscal 2021 (ending on Jan. 31, 2021), the company expects revenues to generate between $725 million to $731 million, compared to analysts’ projections of $728.06 million. HealthEquity anticipates FY21 EPS to be in a range of $1.55 to $1.61, compared to the Street consensus of $1.56 per share. (See HQY stock analysis on TipRanks)

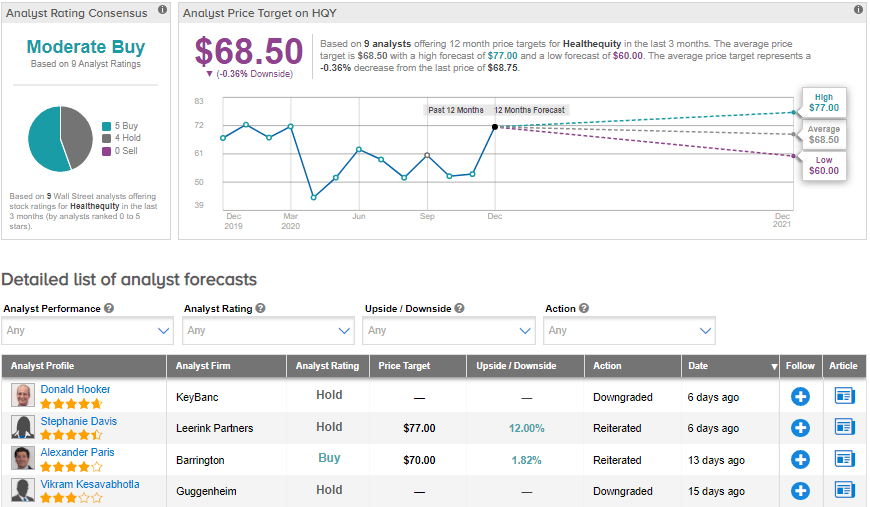

On Dec. 2, KeyBanc analyst Donald Hooker downgraded the stock to Hold from Buy, as the analyst believes that the stock, which has gained about 40% since the announcement of a COVID-19 vaccine on Nov. 9, is now trading at a premium valuation. Hooker foresees headwinds from an uncertain private health insurance environment and low interest rates. The analyst also believes that the company faces a “potentially less” friendly regulatory environment under newly elect US President Joe Biden.

Meanwhile, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 5 Buys and 4 Holds. The average price target stands at $68.50 and implies that the shares are almost fully priced at current levels. Shares have declined by 7.2% year-to-date.

Related News:

Stitch Fix Surprises With 1Q Profit; Shares Spike 34%

Perion Pops 14% Pre-Market On Lifted Sales Outlook; Street Sees 35% Upside

Intuit Raises FY21 Sales Outlook After $7.1B Credit Karma Deal