For toy maker and media property Hasbro (NASDAQ:HAS), things in 2023 didn’t look nearly as strong as they did even a year prior. With “My Little Pony: Friendship is Magic” fading away to be replaced with a significantly less popular replacement, some might have thought Hasbro was about to be dethroned by rival Mattel (NASDAQ:MAT). But that doesn’t seem to be the case, and Hasbro is up over 7% in the closing minutes of Tuesday’s trading session as a result. “My Little Pony” may be waning just as “Barbie” is enjoying a zenith like she’s never seen before, but there’s more up Hasbro’s sleeve, according to Bank of America analysts Jason Haas and Elizabeth Suzuki.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The big winner right now for Hasbro is “Monopoly Go,” the latest variant of Monopoly designed for iOS, which is currently the highest-grossing iOS app in the U.S. So far, just since its mid-April launch, Monopoly Go has brought in better than $200 million in new revenue for Hasbro. Haas and Suzuki are looking for $500 million or better in its first full year, which wouldn’t be hard given what it’s already achieved.

Haas and Suzuki also pointed out that Hasbro has plenty of other IP it can monetize. “Transformers,” “Power Rangers,” “GI Joe,” and a host of others could step in. The interesting part about that is that Hasbro actually tried going to the well for its potential revenue boosts, and the results were, well, mixed. Haas and Suzuki correctly note that Hasbro has plenty of IP. But it’s already brought out multiple “Transformers” movies, two “GI Joe” movies, a blisteringly successful television series in “My Little Pony,” and even movies around lesser-known properties like “Battleship” and “Ouija.” There’s certainly room for more, but the IP is not that fresh. In fact, Hasbro already announced plans to sell the movie business to Lionsgate for $500 million.

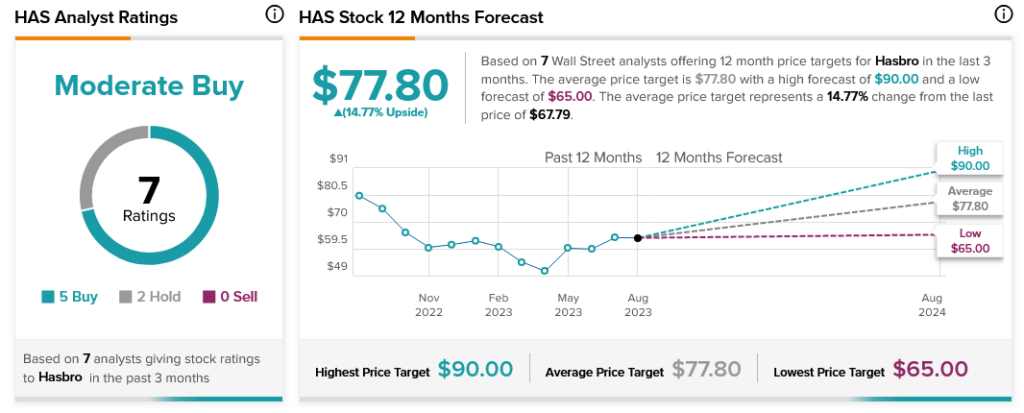

Analysts are, for the most part, backing Haas and Suzuki. Hasbro stock currently stands at a Moderate Buy thanks to five Buy ratings and two Holds. Further, Hasbro stock offers investors 14.77% upside potential thanks to its average price target of $77.80.