An old marketing adage, “sell the sizzle, not the steak,” urges influencing agents to sell the benefits of the product rather than its attributes. In the context of the equities sector, this phrase might be translated to buy the rumor, sell the news, and that’s arguably the framework with which investors should approach iconic toy manufacturer Mattel (NASDAQ:MAT). Therefore, I am bearish on MAT stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

“Barbie” Movie Draws Much Attention to MAT Stock

Earlier this month, TipRanks contributor Joey Frenette argued that MAT stock represented one of three publicly-traded assets that offered great value. Specifically, Frenette called attention to MAT’s forward earnings multiple of 16.2 times, below its five-year average of 43.9 times. Fundamentally, he also mentioned the Barbie film and how it could provide a “nice jolt in the second half” of this year.

With my colleague’s article posted on July 2, his assessment has been proven correct. On the following day, MAT stock closed at $20.04, and on July 12, shares reached as high as $22.15. The Barbie film – which focuses on perhaps Mattel’s most iconic character – will debut on the big screen on July 21.

Narrative-wise, the interest in MAT stock is almost self-explanatory. Months before the release date, Stifel analyst Drew Crum estimated that the movie could haul in $400 million. Further, industry blogs have buzzed about the release, suggesting that the opening weekend could bring in about $31 million.

These aren’t just pie-in-the-sky estimates. As society began normalizing and pandemic-related restrictions began fading in earnest, sentiment at the box office has been pleasantly encouraging. For example, the resounding success of Spider-Man: Across the Spider-Verse implies that the Hollywood industry is marching back to relevance.

If so, this backdrop should benefit MAT stock because the underlying enterprise can reap the rewards of toy sales. That’s the sizzle, which is attractive. However, the steak itself may end up rather dull.

Hollywood Isn’t Always a Great Catalyst for Toys

On paper, nothing could be more appealing for toy manufacturers than to ink compelling product placement deals. While the relationship between entertainment content and underlying associated products will likely always be important, the COVID-19 pandemic changed some of the nuances. For example, the competition spike from streaming platforms could end up stealing market share.

Also, Hollywood machinery doesn’t always provide sustained upside for toy manufacturers. Back when Walt Disney (NYSE:DIS) introduced the character Din Grogu on The Mandalorian – colloquially known as Baby Yoda – demand for Grogu-related merchandise skyrocketed. Indeed, toy company Hasbro (NASDAQ:HAS) stated that Grogu caused a Star Wars toy sales spike in 2020.

You’d think that such a massive catalyst would change Hasbro’s fortunes for the better, and to be fair, HAS popped up from its spring 2020 doldrums and marched steadily forward to its early 2022 peak closing price. Since then, however, the severe deflationary force of the Federal Reserve’s hawkish monetary policy drove Hasbro shares down. Over the trailing five years, HAS shed almost 30% of its value.

That’s not to say that MAT stock will meet the same fate. In fact, it’s almost performing the mirror opposite of its rival, with shares up about 26% in the past five years. Still, MAT hasn’t gone anywhere in the trailing year. Recent history suggests that investors should be careful about banking on product placement to spark upside momentum.

Mattel Stock Isn’t Exactly Cheap

At the moment, the market prices MAT stock at a trailing earnings multiple of 28.97 and at a forward multiple of 18.7. In contrast, the average trailing and forward multiples for the retail (special lines) segment clock in at 19.97 and 22.31, respectively. On balance, prospective investors won’t be getting that much of a discount.

Further, MAT stock trades at a trailing revenue multiple of 1.48x. Against the sector’s average sales multiple of 0.72x, Mattel actually is significantly overvalued, and two factors might make MAT risky here.

First, as society becomes more diverse, toy manufacturers may shift their products toward more inclusive fare. Second, with Barbie dolls’ primary demographic being girls aged three to 12 years old, the total addressable market may be slimmer than some anticipate.

Is Mattel Stock a Buy, According to Analysts?

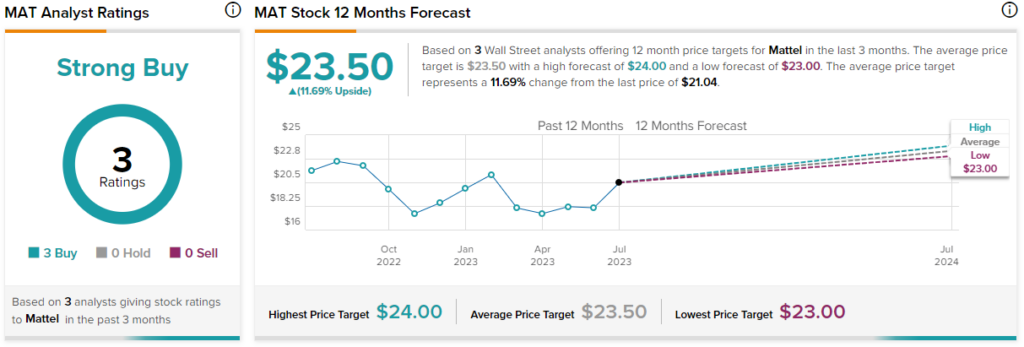

Turning to Wall Street, MAT stock has a Strong Buy consensus rating based on three Buys, zero Holds, and zero Sell ratings. The average MAT stock price target is $23.50, implying 11.7% upside potential.

The Takeaway: MAT Stock Appears More Hype Than Substance

Speculating on MAT stock because of the Barbie film makes sense as a short-term trade on the underlying hype train. However, betting on Mattel for the long term carries risks. First, product placement doesn’t always guarantee financial success. Second, certain social factors may limit the company’s addressable market.