Hasbro (NASDAQ:HAS), the toy retailer, slid in pre-market trading after it announced that it expects to slash an additional 900 jobs over the next 18 to 24 months. Earlier this year, the company announced it would “eliminate approximately 1,000 positions from its global workforce, or approximately 15% of global full-time employees.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to a company memo accessed by CNBC, Hasbro’s CEO, Chris Cocks, commented, “We anticipated the first three quarters to be challenging, particularly in Toys, where the market is coming off historic, pandemic-driven highs.” Cocks added that the headwinds that have persisted throughout this year have lingered into the holiday season and are likely to continue into next year.

In addition, the company expects to deliver gross annual run-rate cost savings of around $100 million thanks to the layoffs. As a result, Hasbro now anticipates gross annual run-rate cost savings in the range of $350 million to $400 million by the end of 2025, which is higher than its prior estimate between $250 million and $300 million.

Is Hasbro a Good Stock to Buy?

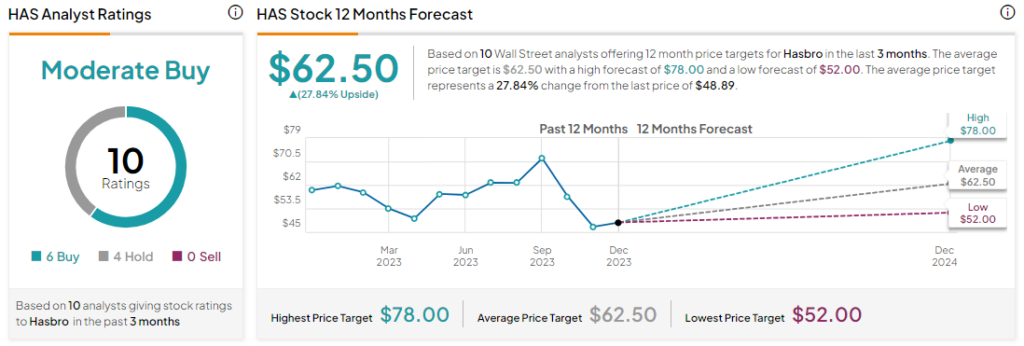

Analysts are cautiously optimistic about HAS stock, with a Moderate Buy consensus rating based on six Buys and four Holds. Year-to-date, HAS stock has slid by more than 15%, and the average HAS price target of $62.50 implies an upside potential of 27.8% at current levels.