Harrow Health (NASDAQ:HROW) shares declined nearly 25% in the pre-market session today after the eyecare pharmaceutical company announced lower-than-anticipated numbers for the third quarter and lowered its outlook for the full year.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

While revenue jumped by nearly 50% year-over-year to $34.3 million, the figure still fell short of expectations by about $3.3 million. Further, EPS of -$0.13 was in sharp contrast to analysts’ estimates of $0.04.

The company ended the quarter with a cash pile of $65.6 million and launched Flarex, Natacyn, Tobradex, Verkazia, and Zerviate in the U.S. during this period. While Harrow’s launch of Iheezo continued to track well, CEO Mark Baum conceded that “Operationally, the third quarter was a mixed bag.”

The company experienced underperformance in its compounding business and the sales of its Fab Five products owing to its strategy of driving Iheezo’s commercialization at the expense of marketing efforts for four of its Fab Five products.

Consequently, Harrow is now three months behind its revenue targets and has taken its financial outlook a notch lower for Fiscal year 2023. Revenue for the year is anticipated to be between $129 million and $136 million, with adjusted EBITDA anticipated between $36 million and $41 million. For Fiscal year 2024, the company expects revenue to be upwards of $180 million.

Is Harrow Health a Good Investment?

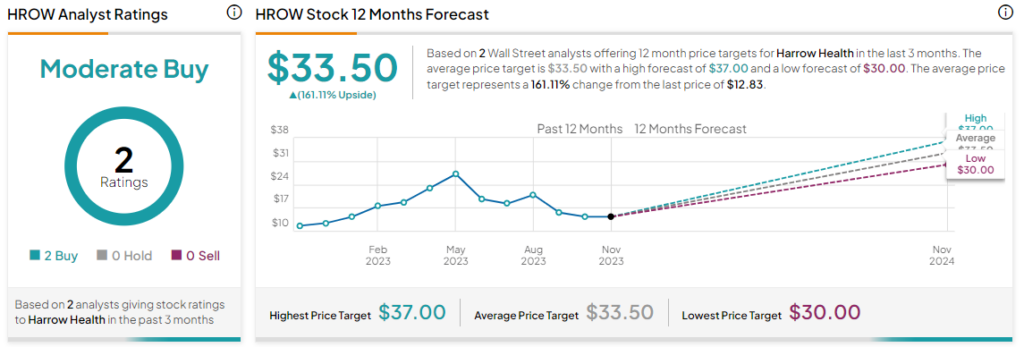

Overall, the Street has a Moderate Buy consensus rating on Harrow Health, and the average HROW price target of $33.50 implies a 161% potential upside in the stock.

Read full Disclosure