While earnings season seems to be providing a boost to many stocks this quarter, it’s hardly universal. Oil stock Halliburton (NYSE:HAL) slipped over 3% in Tuesday afternoon’s trading after its earnings report proved a disappointment.

It’s something of a minor miracle—if of the darkest sort—that an oil stock couldn’t provide good returns in this economy. With oil supply all over getting crimped beyond recognition by the Israel-Hamas war and the ongoing Russian and Saudi cuts, it should be easy for an oil equipment supplier like Halliburton to make gains. But that wasn’t the case; Halliburton’s numbers came out basically on par with what analysts expected out of revenues, but earnings barely cleared the mark. That combination was enough to disappoint investors who were looking for big gains and instead got a barely-budged meter.

Halliburton turned in a beat on earnings, coming in at $0.79 per share. Analysts were expecting $0.77, so a slight win is still a win. And revenue was basically on par, though still something of a miss. Halliburton turned in $5.8 billion in revenue. But analysts were looking for $5.85 billion. It’s a bit fussy to call that a miss, but objectively, even a tiny miss is still a miss. To add insult to injury, that $5.8 billion actually represented an 8.2% jump against the third quarter of 2022’s earnings.

Is Halliburton a Good Stock to Buy Now?

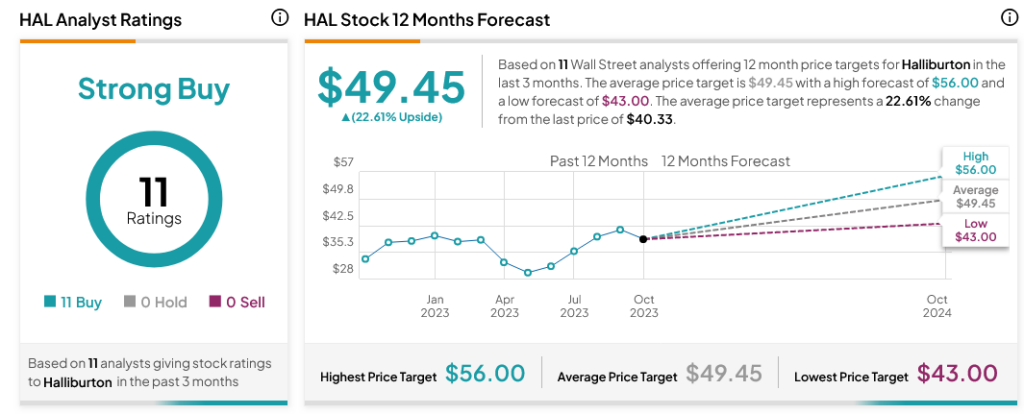

Turning to Wall Street, analysts have a Strong Buy consensus rating on HAL stock based on 11 Buys assigned in the past three months, as indicated by the graphic below. Furthermore, the average HAL price target of $49.45 per share implies 22.61% upside potential.