Recently, it became known that the Department of Justice is planning to file an antitrust lawsuit against Live Nation (NYSE:LYV), as it claims that the entertainment company’s alleged monopoly on live events raises prices for fans. However, Guggenheim analyst Curry Baker, who maintains a Buy rating and $128 price target on Live Nation, disagrees and argues that breaking up the company won’t lower consumer prices. In fact, he thinks the DOJ’s case is weak and likely to fail.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The analyst expects Live Nation to strongly defend itself based on the belief that the DOJ lacks a substantive or winnable case based on precedent and facts. It’s worth noting that, so far, Baker has enjoyed a 69% success rate on LYV stock, with an average return of 11.56% per rating.

Other analysts, like Benchmark’s Matthew Harrigan, doubt the lawsuit will be successful under current antitrust laws, while Oppenheimer’s Jed Kelly lowered his price target to $110 due to the lawsuit’s uncertainty.

Shares of Live Nation shares rose 2.69% in today’s session following an 8% drop on Thursday.

What Is the Price Target for LYV?

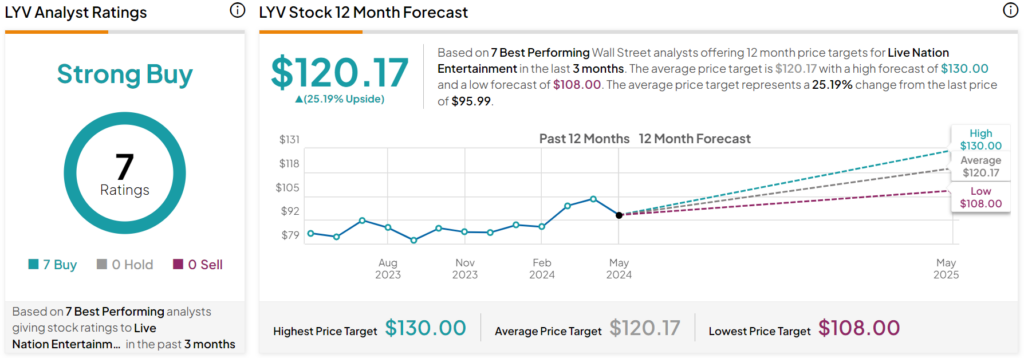

Turning to Wall Street, analysts have a Strong Buy consensus rating on LYV stock based on seven Buys assigned in the past three months, as indicated by the graphic below. After a 17.5% rally in its share price over the past year, the average LYV price target of $120.17 per share implies 25.19% upside potential.