Normally, news of job cuts does good things for share prices. It’s a cost-cutting move and a way to show you’ve got the intestinal fortitude to make the “tough calls.” But Monday afternoon’s trading proved that wasn’t always so, as Goldman Sachs’ (NYSE:GS) share price dipped fractionally after announcing its own plans for staff cuts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Goldman Sachs announced it was planning to cut 123 jobs as merger & acquisition (M&A) activity falls off. With such deals grinding to a comparative halt, the sheer number of staffers required to handle those deals falls accordingly. Thus, Goldman Sachs is looking to pare back its staff. However, it won’t be the minimum-wage tellers, janitors, or what have you getting shown the door. This time, it’s managing directors and investment bankers targeted for dismissal, according to the ever-popular “people familiar with the matter.”

With deal values on the decline—a New York Post report notes that deal values total around $1.2 trillion this year, down 40% against last year’s figures—that’s a pretty fair reason to show dealmakers to the door. In fact, Goldman Sachs is currently the number two global adviser, a position it hasn’t occupied at this point in the year since 2018. This isn’t the first time Goldman Sachs has cut jobs recently, either; back in September, mid-level investment bankers got cut to where between 1% and 5% of the total were dismissed.

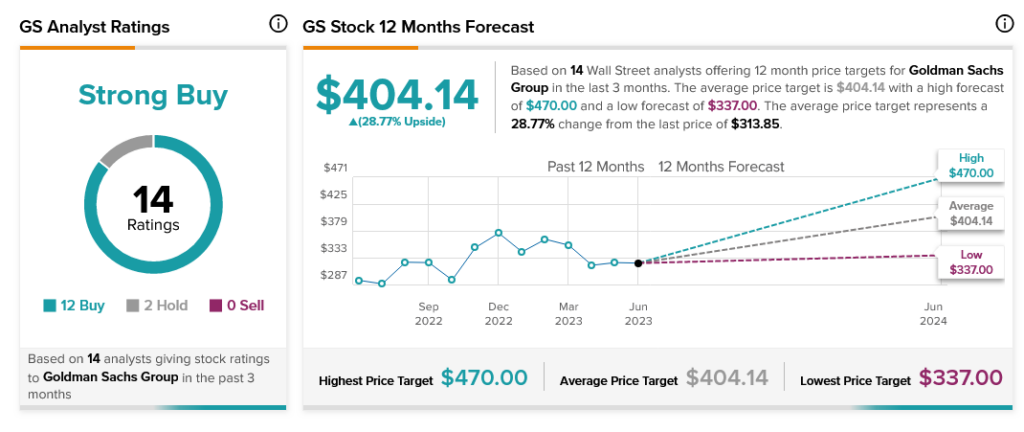

Despite this, however, analysts are very strongly backing Goldman Sachs. With 12 Buy ratings and two Holds, Goldman Sachs stock is considered a Strong Buy. Further, with an average price target of $404.14 per share, Goldman Sachs stock offers its investors 28.77% upside potential.