The risks for tech giant Apple (NASDAQ:AAPL) have been only growing in the last few weeks. While, for the most part, we’ve heard mainly about issues of selling iPhones and how those devices have been unusually easy to find as of late, there are other issues as well. In fact, according to Bank of America analysts, the risks from China are some of the biggest there are for Apple. Despite this, Apple is up fractionally in the closing minutes of Tuesday’s trading session.

Bank of America analyst Wamsi Mohan led the charge here, noting that Apple’s reliance on China is still substantial. Apple relies on China not only to produce its products but also to consume them as well. Throw in the issues of policy coming out of China and it’s a recipe for potentially serious trouble.

However, Mohan maintained both his Hold rating and $208 price target on Apple. There are signs that Apple is working to break away from Chinese production, but these are still largely nascent; only 7% of iPhones are made in India right now, and between 30% to 40% of AirPods and Apple Watches are of Vietnamese make. Those numbers could rise, certainly, but even then, there’s a lot of ground to make up.

In fact, there’s already a new problem on the horizon. Foxconn is currently under investigation by the Chinese government, a move that some are considering “political” in nature. Given that just one plant in China is connected to roughly 80% of all iPhone production, that could mean a near-total shutdown of all iPhone production, a serious problem for Apple. This might be something of a moot point, given issues of declining iPhone demand, but it’s not a solution that works out well for Apple, either.

Is Apple a Buy, Sell, or Hold?

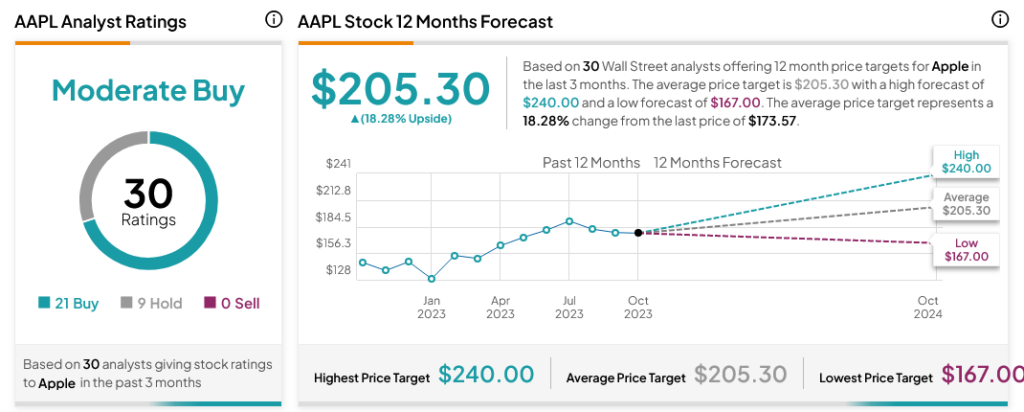

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AAPL stock based on 21 Buys and nine Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average AAPL price target of $205.30 per share implies 18.28% upside potential.