Groupon (NASDAQ:GRPN) shares tanked nearly 30% in the pre-market session today after the local marketplace operator announced disappointing third-quarter results. Indeed, its EPS of -$0.12 lagged estimates by a wide margin of $0.24. Further, revenue of $126.5 million fell short of expectations by $3.2 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Lower user engagement and a decline in goods demand led to a 12% decline in the company’s overall topline. While revenue in North America dropped by 12%, revenue in the company’s International segment plummeted by 14%. Groupon has been focusing on creating an efficient cost structure and was able to narrow its net loss to $40.8 million from $55.5 million in the year-ago period.

Amid this challenging environment, Groupon announced a rights offering of $80 million with a per-share subscription price of $11.30. The firm plans to utilize the proceeds from this move for general corporate purposes, including debt repayment.

But there’s more, Eric Lefkofsky, the company’s co-founder, has left Groupon, effective November 9. Meanwhile, Dusan Senkypl, the Interim CEO of Groupon, noted that while the company did not progress as expected on key projects, it is now shifting its focus “from a cost-cutting first mindset to topline first mindset.”

What is the Price Target for Groupon?

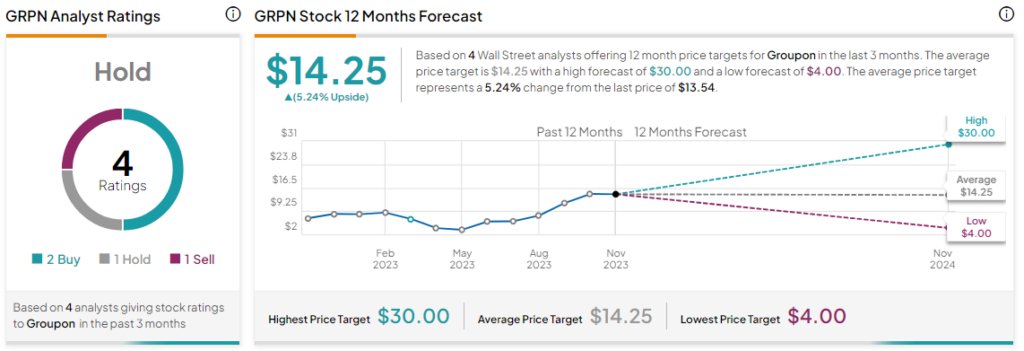

Overall, the Street has a Hold consensus rating on Groupon. Following a nearly 269% rally in Groupon shares over the past six months, the average GRPN price target of $14.25 implies a modest 5.2% potential upside in the stock.

Read full Disclosure