Everything came up aces for e-commerce giant Amazon (NASDAQ:AMZN) over the last few days. It’s advancing in artificial intelligence (AI) development, it’s making new deals, and it just had impressive weekend sales with the Thanksgiving holiday. But all of that together wasn’t enough to slow a fractional drop in Amazon’s share price in Tuesday afternoon’s trading.

Amazon was no slouch when it came to unveiling new items and concepts. Its Amazon Web Services (AWS) division brought out two new processors geared toward training artificial intelligence. The key advantage of these processors—known as Graviton4 and Trainium2—is that both not only have the needed power to train an AI properly but also can do so with less demand on the power grid.

Indeed, Amazon didn’t skimp on power; the Graviton4 chip, for example, boasts 50% more cores, 75% better memory, and, overall, 30% better performance than its predecessor, the Graviton3. It’s also set up new deals with Nvidia (NASDAQ:NVDA) to help further chip use and production. The new deal calls for Nvidia to offer its H200 GPUs through the DGX Cloud.

All This And Monster Sales

Amazon, of course, had more going on than its AI aspirations. It also brought out “record-breaking” sales with its Black Friday events. In fact, it also described the time between November 17 and Cyber Monday—only recently concluded—as the “biggest ever” stretch of sales in the company’s history. Amazon didn’t actually offer any concrete numbers on the point, though it did note that, so far, consumer spending has been keeping pace despite so many factors arrayed against it. Factors like still-massive inflation, increased difficulty getting credit, and growing concerns about employment all chip in to make what should have been a downer shopping season, but somehow, it was not.

Is Amazon Stock a Buy or Sell Right Now?

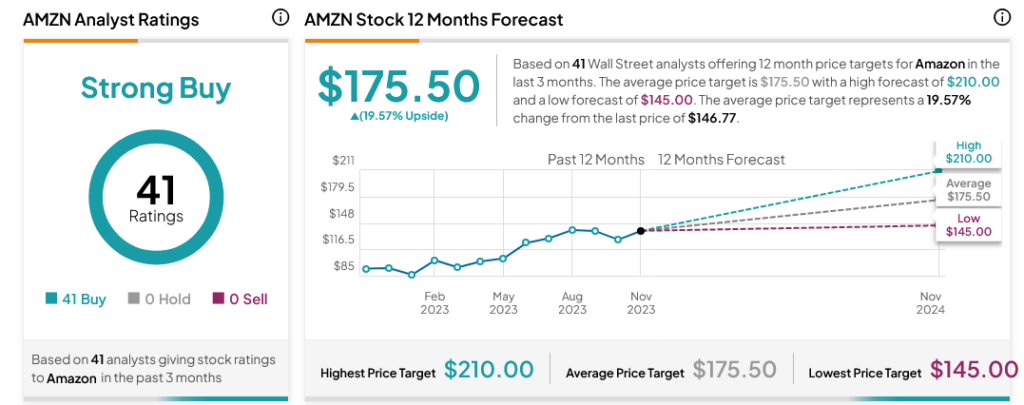

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMZN stock based on 41 Buys assigned in the past three months, as indicated by the graphic below. After a 58.92% rally in its share price over the past year, the average AMZN price target of $175.50 per share implies 19.57% upside potential.