Do you think Black Friday was the deal of the year? Wait until you hear the estimates of the Cyber Monday sale. As per Adobe Analytics, which is a data analytics tool, U.S. e-commerce sales are expected to have reached between $12 and $12.4 billion on Cyber Monday, higher than the previous year’s spending of $11.3 billion. The robust Cyber Monday sales are expected to benefit “buy now, pay later” (BNPL) players such as Affirm Holdings (NASDAQ:AFRM) and retailers including Amazon.com (NASDAQ:AMZN) and Walmart (NYSE:WMT).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The strong sales figures reflect the resilience of American consumers in the face of persistently high inflation and interest rates.

BNPL Stocks in Focus

According to Adobe Analytics, consumers have increased their reliance on “buy now, pay later” (BNPL) options as macro headwinds continue. The tool estimated that consumers processed $782 million worth of transactions through BNPL services yesterday, up 18.8% year-over-year. Interestingly, from November 1 to 27, BNPL purchases grew 14% compared to November 2022. Some of the major players in the American BNPL space are Affirm Holdings, along with private companies Klarna and Afterpay.

Notably, AFRM stock rose over 4% in extended trading yesterday in anticipation of increased BNPL sales. AFRM stock also gained 12% in regular trading on November 27 on news of increased BNPL sales on Black Friday. Affirm is one of the largest players in America, providing BNPL offers on both online and in-store purchases.

Is Affirm a Buy, Sell, or Hold?

Wall Street remains cautious about the AFRM stock’s trajectory. The burgeoning burden of credit on consumers could potentially impact their ability to pay back entire loans. On TipRanks, AFRM stock has a Hold consensus rating based on three Buys, eight Holds, and five Sell ratings. The average Affirm Holdings price forecast of $20.31 implies a whopping 30.9% downside potential from current levels. Year-to-date, AFRM stock has zoomed 222.8%.

Retailers Attract Customers with Massive Discounts

According to the data from Adobe, the average discount offered on electronics shot up to 30% and up to 19% off on furniture items. Noticeably, Mattel’s (NASDAQ:MAT) Barbie movie hyped up sales of Barbie dolls this year. Other popular toy sales included Lego, puzzles, and video gaming devices.

Importantly, e-commerce giant Amazon offered up to 60% discount on private label apparel. Meanwhile, Walmart offered the same discount on tech gadgets. Shopify stock (NYSE:SHOP) also rose nearly 5% yesterday on news of blockbuster Black Friday sales.

Adobe is forecasting that online spending alone during Cyber Week (Thanksgiving up to Cyber Monday) will reach $37.2 billion. This represents a 5.4% year-over-year increase. Remarkably, none of Adobe’s stats are adjusted for inflation, which means the growth rates could be even higher when adjusted.

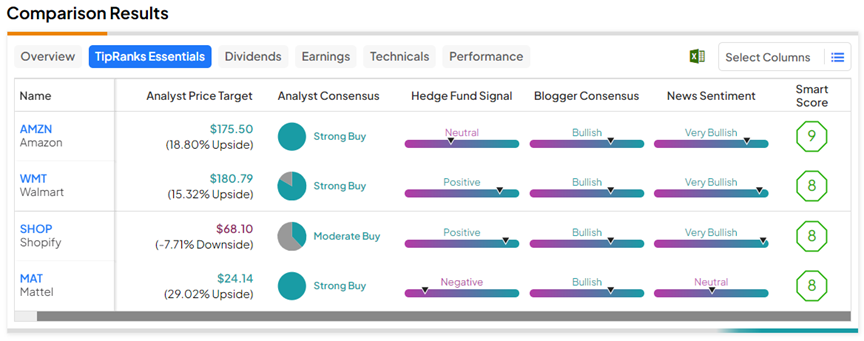

We used our TipRanks Stock Comparison tool to gauge the relative performance of the above-mentioned retail stocks.