Black Friday e-commerce spending jumped 7.5% year-over-year to hit a record $9.8 billion in the U.S., according to an Adobe Analytics report. This comes despite the pressure on consumers’ discretionary spending. As shoppers turn to online shopping, Amazon (NASDAQ:AMZN), with its value pricing and fast delivery, is poised to dominate holiday sales and claim a more significant portion of consumers’ spending.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Let’s delve deeper.

Amazon Among Top Shopping Destinations

A survey conducted by Goldman Sachs indicated that holiday season sales might surpass initial expectations. Moreover, the survey showed that Amazon and Walmart (NYSE:WMT) continue to be the top shopping destinations for holiday shopping.

Amazon’s strategy of providing value to consumers through discounts and promotions is anticipated to boost its Prime membership and overall sales. Additionally, during the Q3 conference call, the company’s management emphasized that its inventory is exceptionally well-positioned for the upcoming holiday season. This enables Amazon to offer customers swift delivery services from their local areas.

Amazon’s CFO Brian Olsavsky said during the Q3 conference call that year-to-date, the company achieved its fastest delivery speeds ever in the United States. These enhancements in delivery speeds have played a crucial role in driving growth and have led to an increased frequency of purchases by Amazon Prime members. As Amazon is well-positioned to dominate the holiday season sales, let’s look at what the Street recommends for AMZN stock.

What Do Analysts Say About Amazon?

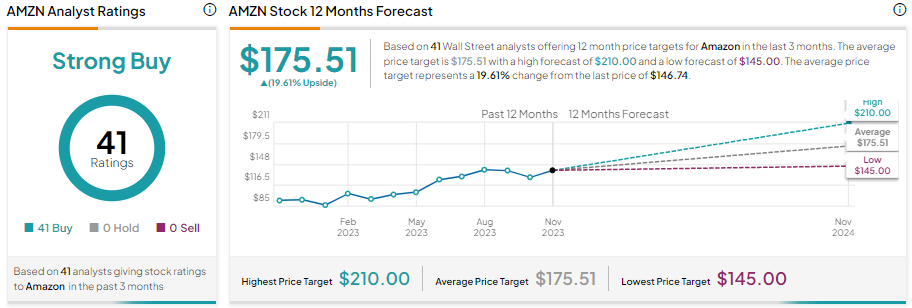

Wall Street analysts maintain a bullish view about Amazon’s prospects due to its leadership in the e-commerce and cloud space. Further, Amazon’s focus on reducing its cost structure and driving profitability and investments in AI (Artificial Intelligence) support its bull case.

Every analyst covering AMZN stock recommends buying it. While the stock carries a Strong Buy consensus rating, the average price target of $175.51 implies an upside potential of 19.61% from current levels.