One of the latest, and some might say the biggest, legal troubles for tech greats Meta Platforms (NASDAQ:META) and Google (NASDAQ:GOOG) was the Online News Act in Canada. Canada’s attempt to prop up local news by demanding these two major aggregators pay up for access wasn’t taken lightly by either major corporation. Now, with news that Canada is ready to adjust the act’s provisions somewhat, both Meta and Google are down fractionally in Friday afternoon’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Google and Meta both responded to the Online News Act by largely cutting out the Canadian market altogether. Meta pulled news altogether, while Google threatened to do likewise but has yet to follow through. With two major sources of news in Canada lost or threatened, however, that’s left Canadians struggling and complaining to government officials who caused this mess to begin with. Thus, Canada is looking to deal with and backpedal some of the act’s key principles.

One of the biggest problems was liability for Google and Meta and how that may be unlimited under the current act as it stands. Naturally, neither liked the notion much, and that was reason enough to stay out. But the Canadian government did move to put at least a clearer price tag on things, even if that tag still worked out to a combined total of $234 million. However, that also includes some “non-monetary” transactions that might include things like training and advertising credits. Reports suggest Meta is less than happy with even the proposed modifications.

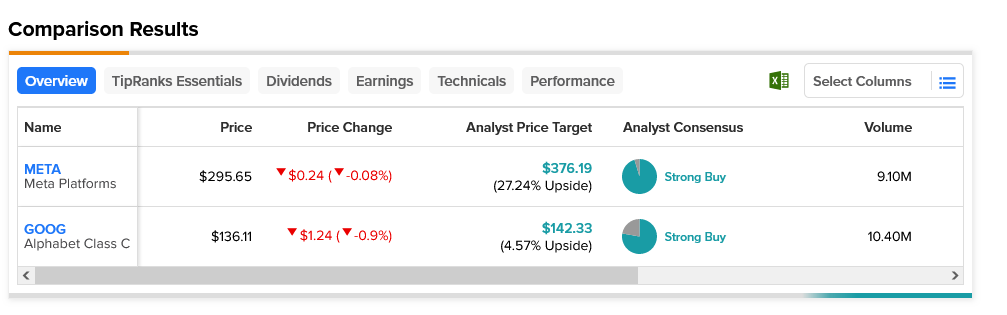

Meanwhile, analysts aren’t exactly unhappy with how things are going for Meta and Google. Both are considered Strong Buys by analysts. The only real difference is in terms of upside potential. Google stock’s average price target of $142.33 gives it an upside potential of 4.57%. However, Meta Platforms stock’s $376.19 average price target gives it an upside potential of 27.24%.