Shares of Goodyear Tire (NASDAQ:GT) surged after activist investor Elliott Investment Management revealed a 10% stake in the company and expressed intentions to secure five board positions and push for the divestment of Goodyear’s company-owned stores. Elliott urges the tire manufacturer to explore ways to monetize the store network, undergo a thorough operational assessment, and concentrate on enhancing its profit margins.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The hedge fund is confident that if Goodyear follows these suggestions, the company could unlock value amounting to more than $21 per share. This value creation starts with the sale of Goodyear’s store network, which Elliot believes could result in a stock price increase of over $4 per share. The remaining value will be created with an in-depth analysis of Goodyear’s SG&A expenses, coupled with a revamp of its go-to-market and brand strategies, which could lead to a significant boost in operating margins.

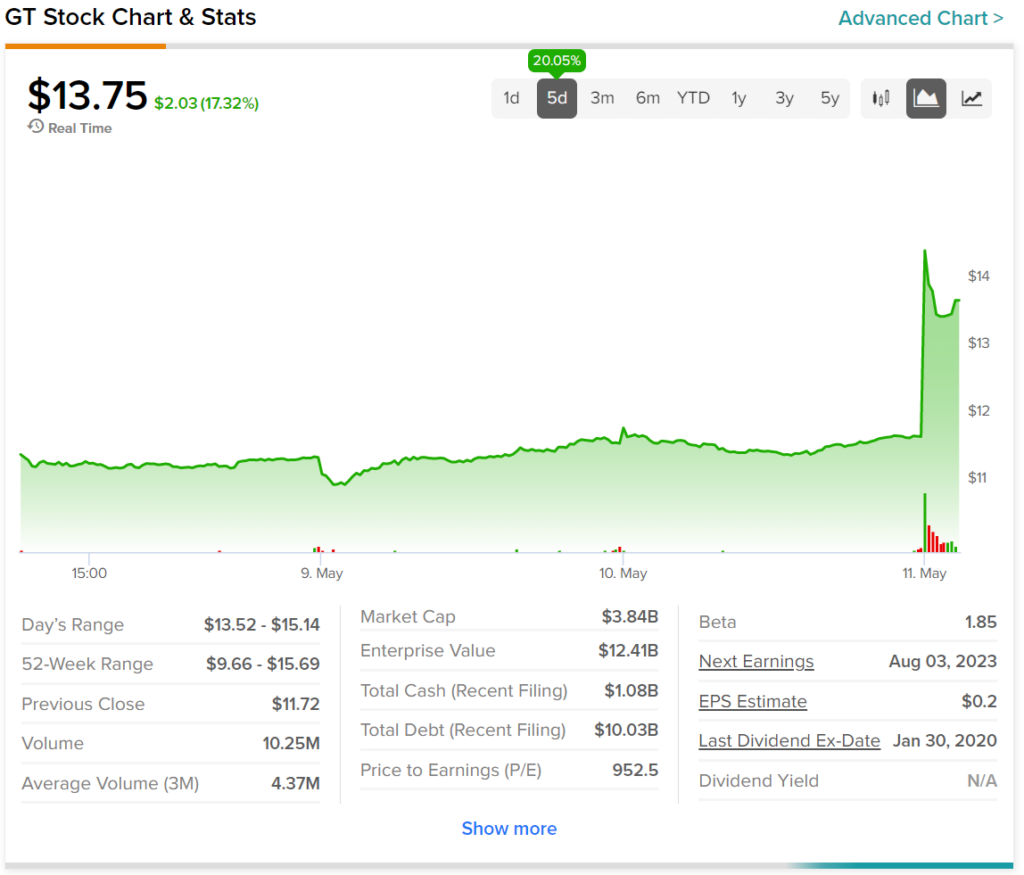

A look at the past five trading days for GT stock highlights the level of impact today’s news had on it. Indeed, shares jumped over 17% at the time of writing. As a result, investors are now up 20% during this timeframe.