Leading investment bank Goldman Sachs (NYSE:GS) is set to cut at least 400 jobs in its struggling consumer banking business, Bloomberg reported citing people familiar with the matter. These layoffs will be in addition to the annual reduction of underperforming staff. It also intends to stop originating unsecured consumer loans in the coming months as the consumer banking business is expected to continue to be under pressure due to macro challenges.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Goldman Sachs started its consumer banking business, called Marcus, in 2016. Marcus started as an online platform offering personal loans and savings accounts to retail customers. However, the business struggled to thrive due to multiple reasons, including executive turnover and product delays.

In October 2022, Goldman Sachs announced that it was reorganizing its businesses into three units to drive efficiency. The bank combined trading and investment banking into one unit, asset management, wealth management, and consumer business into another, and its digital offerings in a third division called Platform Solutions. The firm is reviewing its businesses amid rising costs, a slowdown in dealmaking, and a slump in asset prices.

During its Q3 earnings call, Goldman Sachs disclosed that its consumer business has over $110 billion in deposits and more than 15 million customers. The firm will continue with its savings account offering as it is a key source of funding. However, it will stop the beta testing of its checking account among employees.

Is GS Stock a Buy?

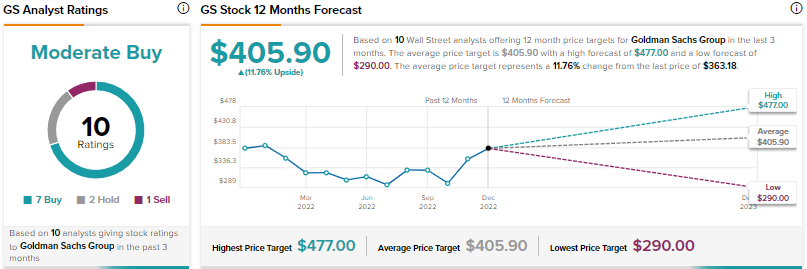

Wall Street is cautiously optimistic about Goldman Sachs, with a Moderate Buy consensus rating based on seven Buys, two Holds, and one Sell rating. At $405.90, the average GS stock price target suggests nearly 12% upside potential. Shares have declined 5% year-to-date.