Goldman Sachs (NYSE:GS) is undergoing some more reshuffling of leadership roles. The investment bank has reportedly sacked several employees within its transaction banking division due to violations of its communications policy. One of the executives affected by these changes is Hari Moorthy, who previously served as the head of the unit.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The communications policy mandates that employees must use bank-approved channels for business-related communication. It appears that the terminated employees did not adhere to this policy. Also, they did not cooperate with Goldman’s compliance unit.

Owing to Moorthy’s exit, Goldman’s global treasurer, Philip Berlinski, will temporarily oversee the day-to-day operations of the transaction banking business. Berlinski will perform the task alongside Akila Raman (chief commercial and strategy officer of transaction banking) and Luc Teboul (head of technology at the transaction banking division).

Multiple Changes in Leadership

It is worth highlighting that Goldman recently disclosed changes in the leadership of several of its business units.

Earlier this week, the bank announced the appointment of chief administrative officer Ericka Leslie as the chief operating officer (COO) of Goldman’s Global Banking and Markets division. Additionally, Will Bousquette, who had been overseeing global banking, will take on the role of COO of the Asset and Wealth Management unit.

These organizational changes stemmed from the departure of two key employees earlier this year – Julian Salisbury, who served as the Chief Investment Officer of Asset and Wealth Management, and Dina Powell McCormick, who led Goldman’s sovereign business.

Is GS Stock a Good Buy?

Last month, several major banks made headlines due to penalties related to record-keeping lapses. Thus, Goldman’s move to review its internal controls and processes and take corrective actions is justified. However, the ongoing turnover in top-level executives and macro pressures might have led to analysts’ cautiously optimistic approach to the stock.

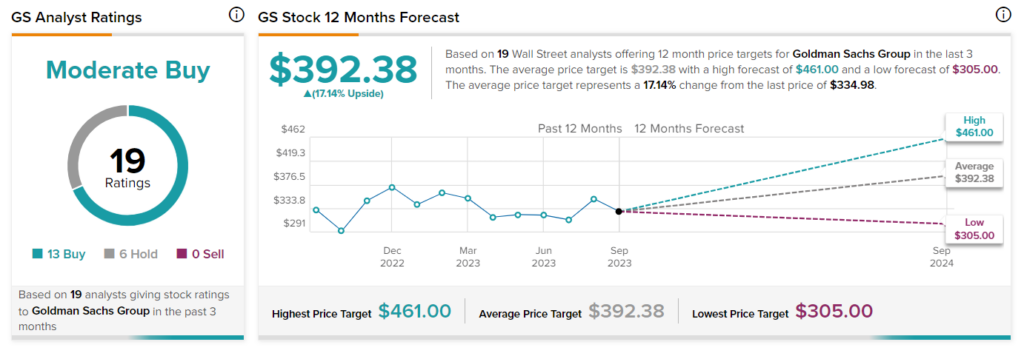

GS stock has a Moderate Buy consensus rating on TipRanks based on 13 Buy and six Hold recommendations. Analysts’ average 12-month price target of $392.38 implies 17.14% upside potential from current levels.