Big U.S. banks, including Citigroup (NYSE:C), Goldman Sachs (NYSE:GS), Morgan Stanley (NYSE:MS), Wells Fargo (NYSE:WFC), and JPMorgan Chase (NYSE:JPM), are coughing up money as a penalty for record-keeping lapses.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In the latest development, the SEC (Securities and Exchange Commission) has fined Citigroup’s Global Markets business unit $2.9 million, accusing it of violating record-keeping requirements in the underwriting segment. Separately, a Wall Street Journal report highlighted that the Commodity Futures Trading Commission slapped a $5.5 million penalty on Goldman Sachs for its failure to record and retain mobile phone calls when the COVID-19 pandemic began.

Last week, Morgan Stanley agreed to pay £5.41 million or $6.82 million to settle an investigation by the UK’s energy markets regulator for violating record-keeping requirements. Further, at the beginning of this month, Wells Fargo, BNP Paribas (BNPQY)(FR:BNP), and other financial services firms agreed to pay nearly $555 million in fines on similar grounds. Also in June, JPMorgan Chase’s investment management company, J.P. Morgan Securities, agreed to pay $4 million in a settlement with the SEC.

While these penalties are meager for these large corporations, they raise concerns over remote work compliance and violations. With this backdrop, let’s look at what the Street forecasts for the top U.S. banks.

Which Bank Stock is Best to Buy Now?

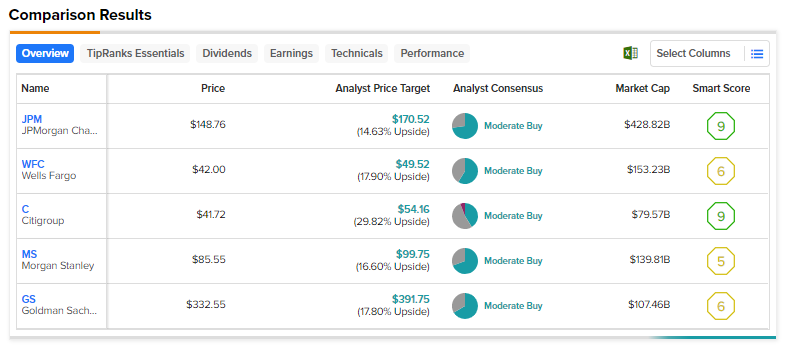

TipRanks’ Stock Comparison tool shows that Wall Street analysts are cautiously optimistic (with a Moderate Buy consensus rating) about top bank stocks. While higher interest rates and modest loan growth will likely drive the NIIs (Net Interest Incomes) of these financial services firms, challenges from rising deposit costs and weak investment banking activity will likely remain a drag.

However, JPM and Citigroup stocks carry an Outperform Smart Score of nine. Investors should note that TipRanks’ Smart Score tool is a proprietary quantitative stock scoring system. It provides a score from one to ten (10 being the best) on stocks based on eight key factors such as Wall Street analysts’ ratings, corporate insider transactions, technical analysis, and fundamentals, among others.

Moreover, Citigroup stock offers the highest upside potential (+29.82%) among these large-cap banks.