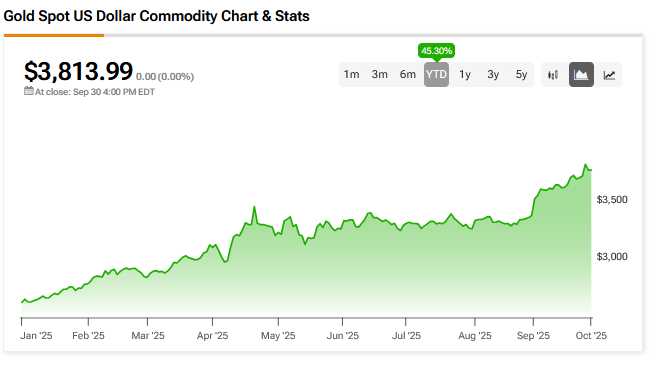

It is now “inevitable” that the gold price will breach the magical level of $4,000 an ounce, buoyed by global political and economic turmoil.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Faster Cuts

Kathleen Brooks, research director at XTB, said the market is once again pricing in a faster pace of interest rate cuts in the U.S. given concerns over the health of the U.S. labor market.

This followed weak U.S. private sector payrolls data yesterday.

“The market now expects 4 to 6 cuts in this monetary loosening cycle, with interest rates falling below 3% in a year’s time,” said Brooks. “A break above $4,000 seems inevitable.”

That’s because gold tends to do better in times of lower interest rates.

The U.S. government shutdown also drove investors to the safe haven of gold today, helping the spot price climb at one point to $3,875. That’s just $20 shy of the record peak it reached earlier this week.

The metal has soared 45% this year, putting it on track for the biggest annual gain since 1979. The rally has also been supported by central bank buying, a weaker dollar and geopolitical crises from Ukraine to the Middle East.

ETFs Deliver

Monthly inflows into gold-backed ETFs in September were the largest in three years, according to data compiled by Bloomberg. Chinese buyers were also scooping up more gold-backed funds, with the four most popular registering inflows last month following a period of tepid demand.

The SPDR Gold Shares ETF (GLD) is up 46% so far this year with the VanEck Gold Miners ETF (GDX) up 125.30%.

Goldman Sachs (GS) expects investor demand to remain shiny. Daan Struyven said in a note that the potential for private investors to diversify significantly into gold presents a “large upside risk” to its forecast of $4,000 per ounce for mid-2026 and $4,300 per ounce for the end of next year.

The bank said a month ago that gold can near $5,000 an ounce were it to see inflows from just 1% of the privately-owned US Treasury market.

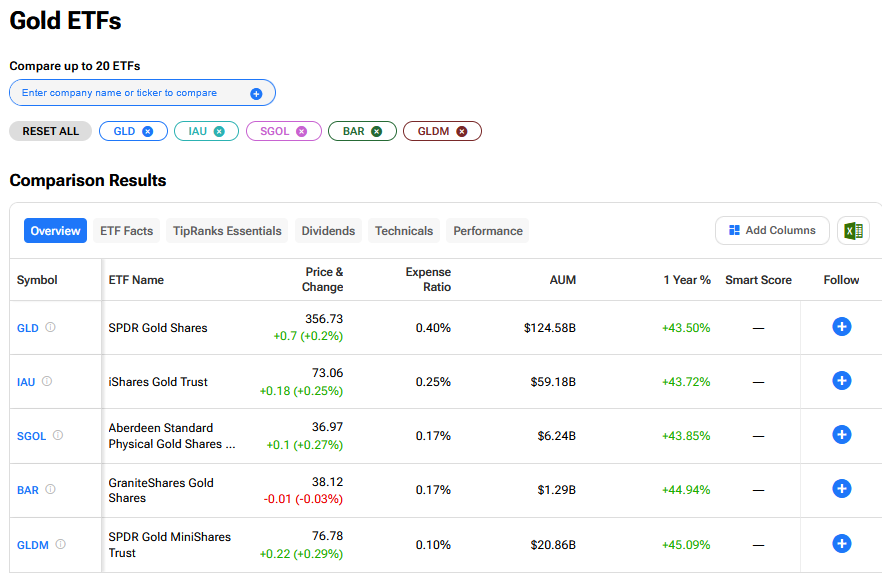

What are the Best Gold ETFs to Buy Now?

We have rounded up the best gold ETFs to buy now using our TipRanks comparison tool.