It’s almost time for PayPal (NASDAQ:PYPL) to drop its latest financial statement. Once the market action comes to a halt on Wednesday (February 7), the digital payments giant will report 4Q23 earnings.

Looking ahead to the results, Deutsche Bank analyst Bryan Keane is anticipating “relatively in-line 4Q23 results, with the company continuing to be plagued by share loss in its core Branded business and weak transaction revenue growth.”

That said, Keane thinks the actual performance will be less of a priority for investors with the focus turning to new CEO Alex Chriss’ strategy on how to fix the business.

“We would encourage PYPL to focus on turning top-line net transaction revenues around, even if it means forgoing margins and profitability in the near term,” Keane opined.

Numbers-wise, Keane is calling for revenue growth of 6.2% year-over-year (7.2% y/y constant currency) with the top-line figure landing at $7.84 billion, roughly the same as consensus at $7.86 billion. Likewise on the bottom-line, Keane’s EPS forecast of $1.36 is the same as the Street’s and factors in y/y growth of 9.4%.

Looking ahead to the guide, based on the company’s shift towards unbranded volumes, Keane expects both revenues and the net transaction take rate to see “incremental pressure in FY24.”

Still, Keane is calling for revenue growth of 7.1% (7.6% y/y cc compared to 9.2% cc beforehand) vs. last year and EPS growth of 9.8%, below his prior forecast of 11% bottom-line growth.

All told, Keane remains in PayPal’s corner although he thinks investors should take a long-term view here. “The turnaround story at PYPL should be viewed over the next few years with progress hopefully showing up over the coming quarters,” he summed up.

To this end, Keane maintained a Buy rating on PYPL stock backed by a $74 price target. The implication for investors? Upside of ~18% from current levels. (To watch Keane’s track record, click here)

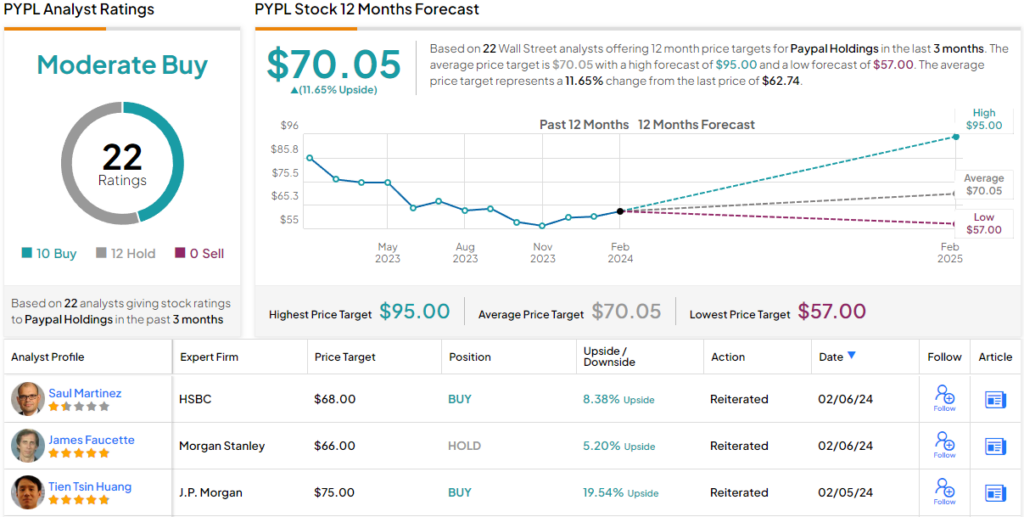

Elsewhere on the Street, the bulls and skeptics are evenly matched. With an additional 11 Buys and Holds, each, the stock claims a Moderate Buy consensus rating. The forecast calls for one-year returns of ~12%, considering the average price target currently stands at $70.05. (See PayPal stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.