Shares in automaker General Motors (GM) powered forward today as it said rampant EV demand had helped it to beat Q3 earnings forecasts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Charged Up

GM, whose brands include Chevrolet, GMC and Cadillac, said it had seen a record 67,000 EV sales during the period, giving it a 16.5% share of the U.S. market. It said that it now led the EV industry in market share growth in 2025 to date with the lowest incentives of any major OEM.

Indeed, it said its EV sales had more than doubled this year with the Equinox EV now the best-selling non-Tesla (TSLA) EV.

It helped GM report revenues for the period of $44.26 billion compared with the $45.18 billion forecasted. It revealed Q3 adjusted EPS of $2.80 versus the $2.27 expected.

GM also now sees full-year profits of between $12 billion and $13 billion compared with previous expectations of $10 billion to $12.5 billion. It also forecasts adjusted earnings per share of $9.75 to $10.50 diluted versus $8.25 to $10.00 before.

Tariff Hopes

Investors were also cheered by GM’s confidence that the worst of the impact from President Trump’s tariffs may be in the rearview mirror. It said that its full-year tariff exposure is now seen at around $3.5 billion to $4.5 billion, assuming current levy rates remain the same, and that indirect costs from suppliers do too.

Earlier this year, the automaker lowered its full-year guidance to include a possible $4 billion to $5 billion impact from auto tariffs.

It has been one of the key factors holding the company’s share price back this year – see below:

The company also pointed to record sales of SUVs and growing demand for its Super Cruise, OnStar and other software and services.

GM vehicles with available Super Cruise use real-time cameras, computers, sensors, GPS data, and precision maps to allow drivers to remove their hands from the wheel under specified conditions.

“We are focused on driving EV profitability, maintaining production and pricing discipline, managing fixed costs, and further reducing tariff exposure,” said GM’s chief executive Mary Barra.

Is GM a Good Stock to Buy Now?

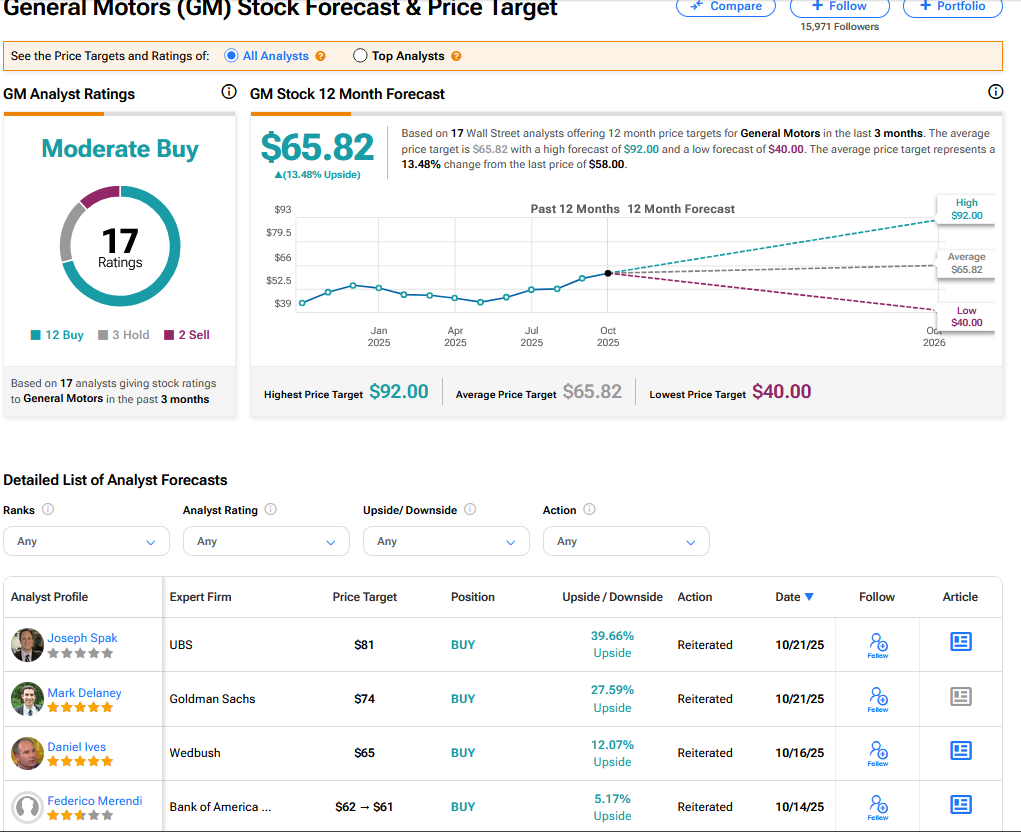

On TipRanks, GM has a Moderate Buy consensus based on 12 Buy, 3 Hold and 2 Sell ratings. Its highest price target is $92. GM stock’s consensus price target is $65.82, implying a 13.48% upside.