Shares of Glu Mobile surged 27% on November 6, reaching its highest point since August, after its Q3 results beat on both the top and bottom-lines, with it also lifting its forward-looking guidance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Glu Mobile (GLUU) reported record revenue of $158.5 million, exceeding the consensus estimate by $21.6 million and reflecting a 48% year-over-year gain. EPS landed $0.06 above the analysts’ forecast. The mobile game maker also posted bookings of $147.3 million (up 22% year-over-year), compared to the Street’s $137.4 million call.

According to management, the bookings growth was fueled by the strong performances of the Design Home, Covet Fashion and Kim Kardashian Hollywood games.

“We followed up a very strong second quarter with a better-than-expected third quarter that saw year-over-year bookings growth of 22% led by the continued strong performance of our Growth Games… Our focus on margin expansion led to significantly higher profitability driven by greater productivity from our marketing spend,” GLUU’s CEO Nick Earl said.

What’s more, in Q3, the company introduced a new food and décor themed game, Table & Taste, the third title launched by Crowdstar, which was acquired by Glu Mobile in 2016.

“Table & Taste, which will serve the culinary category and complement our Crowdstar brand perfectly with a larger and more diverse addressable user base,” Earl commented.

Going forward, GLUU now expects to generate FY20 bookings of between $555.3-$560.3 million. Thanks to its core Crowdstar and Glu Sports brands, the company believes it will see a “very strong” end to the year, with it anticipating additional growth in 2021.

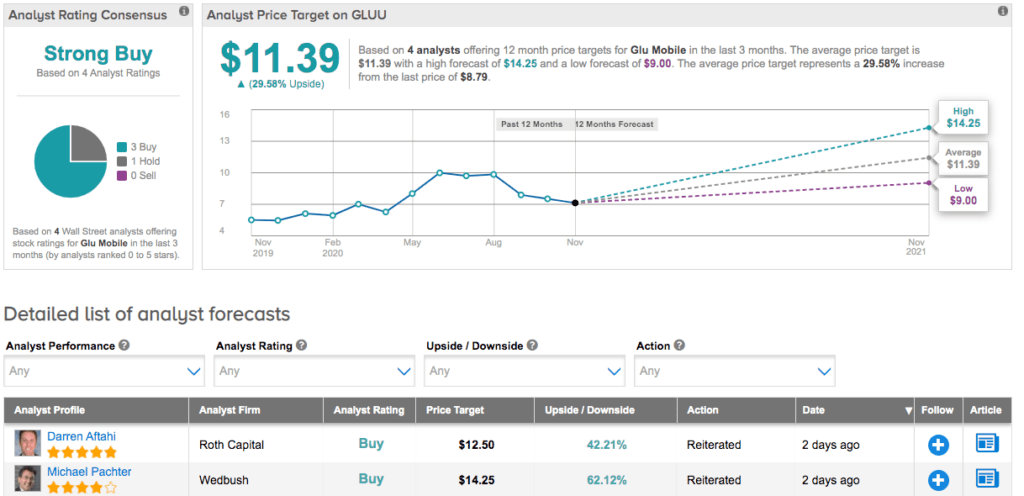

In 2020, shares of Glu Mobile have climbed 45% higher, with it receiving primarily bullish support from Wall Street analysts. A Strong Buy analyst consensus breaks down into 3 Buys and a single Hold. At $11.39, the average analyst price target suggests 30% upside potential. (See Glu Mobile stock analysis on TipRanks)

In response to the strong print, Wedbush analyst Michael Pachter sided with the bulls. He boosted the price target for GLUU from $11.50 to $14.25, putting the upside potential at 62%. Along with the price target update, the analyst reiterated a Buy rating.

Related News:

Uber Posts Worse-Than-Feared Loss On Weak Rides Demand; Wedbush Raises PT

ViacomCBS Drops 6% As 3Q Profit Drops 17%; Needham Says Buy

Walmart To Record $1B Loss From Argentina Business Sale