SGX-listed Wilmar International Limited (SG:F34) offers a balance of capital appreciation and dividend growth to investors. According to analysts’ assessments, the stock has received a Strong Buy rating and is expected to grow by over 20%. Additionally, for investors seeking income, the stock boasts a dividend yield of 4.62%, outperforming the industry average of 2.12%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Wilmar International is an agribusiness company engaged in the processing, trading, and distribution of various commodities. The company has a diversified product range, including edible oils, sugar, flour, rice, and many more.

The Wilmar share price has experienced a loss of over 9% in trading YTD.

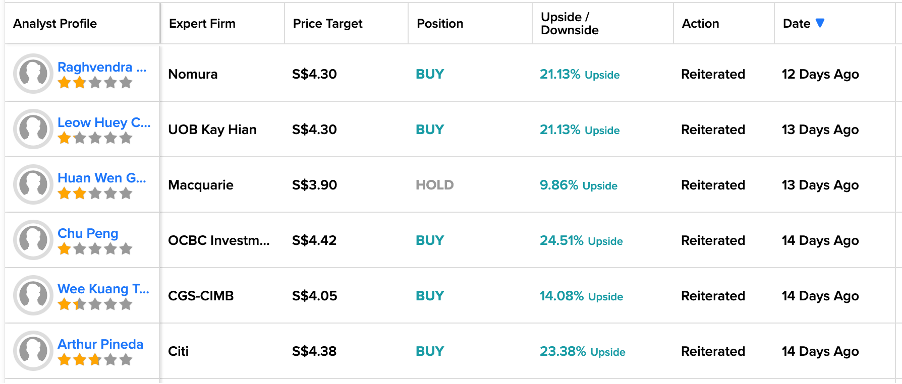

Analysts’ Opinion

Despite disappointing Q2 2023 earnings reported by the company earlier in August, analysts maintained their Buy ratings on the stock. Over the last 15 days, five analysts have confirmed their Buy ratings on the stock, while one has maintained his Hold rating.

Analysts believe that the company’s near-term earnings might be impacted by the temporary weakness in demand from China. Nonetheless, the company holds substantial prospects for growth within its integrated food products platform, particularly in its downstream division. Analysis anticipates that this strategic shift will result in the formation of a more reliable earnings foundation moving forward.

Most recently, 12 days ago, analyst Raghvendra Divekar from Nomura reiterated his Buy rating on the stock, predicting more than 20% upside.

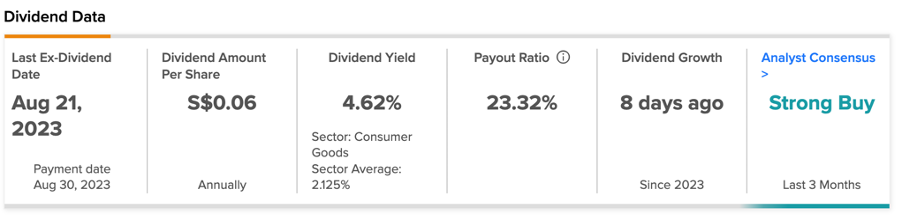

What is the Interim Dividend for Wilmar?

Wilmar maintained an interim dividend of S$0.06 per share, similar to the interim payment made last year. The company distributes its dividends semi-annually and has maintained a consistent dividend level over recent years, except for the reduction following the impact of COVID-19.

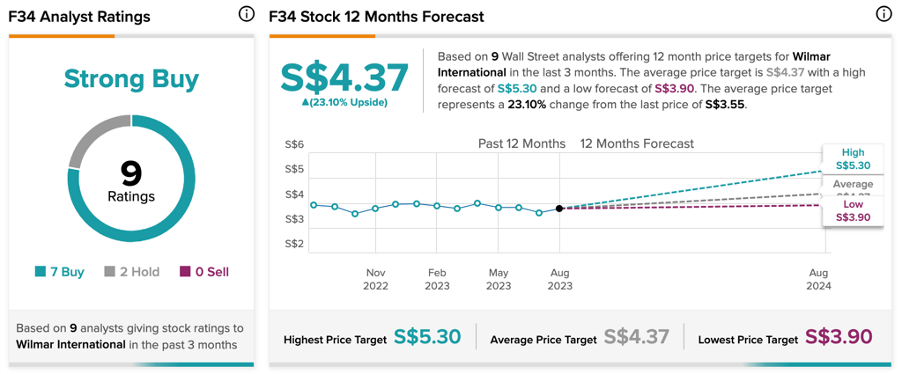

What is the Target Price for Wilmar?

The Wilmar share price target is S$4.37, which reflects a growth of 23% from the current trading level. Based on the analysis from TipRanks, the consensus among analysts for F34 stock is categorized as a Strong Buy, comprising seven Buy recommendations and two Hold recommendations.

Conclusion

Despite the volatility observed in commodity markets, Wilmar has managed to achieve consistent growth in profits over successive years. Additionally, a relatively stronger second half of the fiscal year 2023 is expected, which is consistent with seasonal patterns and the prospects for improved profit margins.

Given the thumbs-up from analysts, investors might find it worthwhile to contemplate the stock for potential enhanced returns.