The share price of German software company SUSE SA (DE:SUSE) gained almost 60% on Friday after its majority shareholder, EQT AB, announced its intentions to take the company private. Global investment company EQT is currently the largest shareholder in the company with a 79% holding, and it intends to buy the remaining stake, valuing SUSE at €2.7 billion.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

EQT AB is offering SUSE shareholders a substantial 67% premium over the stock’s last trading price on Thursday. This move will also allow current shareholders to retain their investment in a private context.

The company has supported the offer and is optimistic about the strategic potential of privatizing the company. The deal value of €2.7 billion reflects a considerable increase compared to its market capitalization prior to the announcement of the transaction. EQT envisions SUSE being delisted during the final quarter of 2023.

Based in Germany, SUSE is a technology company that provides open-source solutions to multiple businesses. It caters to various sectors like automotive, healthcare, retail, manufacturing, pharmaceuticals, etc.

The Share Price Story

EQT facilitated the public listing of the company in 2021; however, the company’s shares experienced a decline of around 50% since its IPO. In the past six months, the stock has experienced a decline of nearly 20%, but it has shown a recent increase of 42% in the last month. Overall, SUSE’s stock is not that famous in the German market, but it has managed to catch investors’ attention in the last month.

In July, the company announced its Q2 2023 earnings with after-tax losses, sending the share further down. The company’s revenues grew by a mere 1% to $161.9 million, and it also reported a net loss of $25.5 million, down from $26.4 million the previous year. The company attributed the shortfall to ongoing economic uncertainty affecting customer decision-making and delayed contract signings.

SUSE Share Price Target

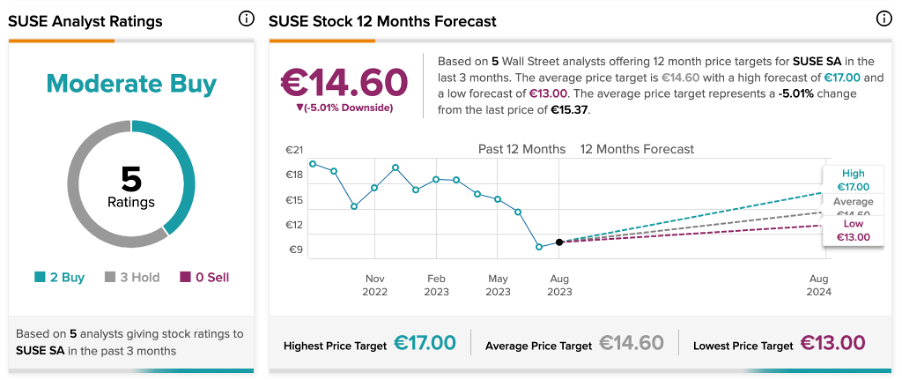

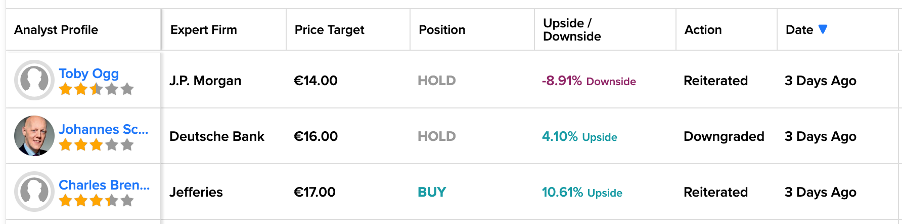

Post-announcement, Jefferies analyst Charles Brennan kept his Buy rating on the stock. His price target of €17 implies a 10% growth in the share price.

On the contrary, three days ago, Toby Ogg from J.P. Morgan reiterated his Hold rating on the stock, predicting a downside of 9%.

According to TipRanks consensus, SUSE stock has received a Moderate Buy rating based on two Buy and three Hold recommendations. The average price forecast is €14.6, which is 5% below the current trading level.