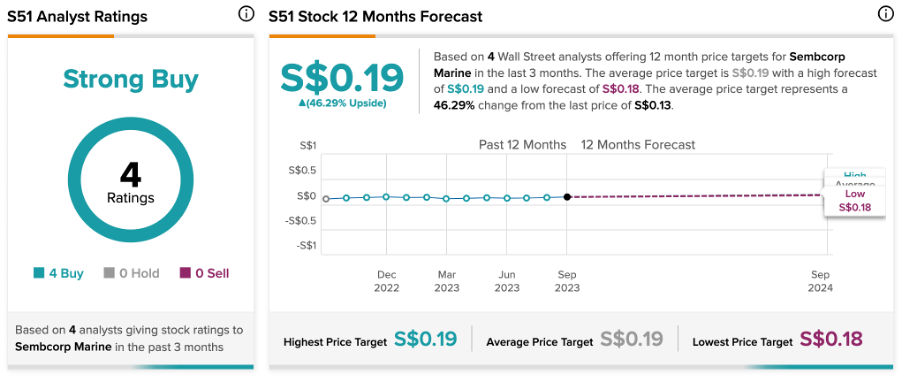

According to analysts, the share price of the SGX-listed Seatrium Limited (SG:S51), previously operating under the name Sembcorp Marine, offers solid growth potential with a projected increase of over 45% in its share price. Analysts hold a bullish view of the stock, considering the huge order wins for the company, which will drive future earnings.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company changed its name from Sembcorp Marine Limited to Seatrium Limited following the completion of its merger with Keppel Offshore & Marine Limited in April 2023. The combined entity specializes in delivering extensive engineering solutions to the offshore, marine, and energy sectors worldwide. Following their merger, the company has become one of the largest shipbuilders globally. As of August 2023, the company has a combined orderbook of around S$20 billion and could potentially secure an additional S$7 billion in contracts in the upcoming FY24. This also includes the increasing volume of orders from contracts related to renewable energy.

What Are Analysts Predicting?

Analyst Pei Hwa Ho from DBS, in her recently issued note, has maintained her bullish view on the stock. She stated that post-merger losses are expected to decrease in FY2023, although there might be potential integration challenges and costs that could pose some downside risks this year. Nonetheless, Ho predicted the company would leverage synergies from the merger, achieving cost efficiencies and revenue growth and ultimately becoming profitable by Fiscal Year 2024.

She further added that the share price has lost 88% over the last five years, but she believes the situation is now changing. Ho has a price target of S$0.18 on the stock, predicting a growth of 37.4%.

Analyst Lim Siew Khee from CGS-CIMB also confirmed her Buy rating on the stock last month, after the company won a contract from Shell (GB:SHEL) for its services for the Sparta project in the U.S. Gulf of Mexico. She estimated the contract value for Seatrium to range between S$300 million and S$400 million, with an anticipated EBIT margin of 7% to 8%.

She is optimistic that Seatrium is well-positioned to secure additional significant contracts.

What is the Forecast for Seatrium?

The S51 stock has been rated as a Strong Buy on TipRanks, supported by unanimous Buy recommendations from four analysts. The Seatrium share price target is set at S$0.19, reflecting a 46.3% increase from the current trading level.