The share price of the UK-based Vistry Group PLC (GB:VTY) fell sharply today after the company posted a mixed Q3 trading update. Also, the group announced around 200 job cuts as a part of its restructuring efforts disclosed last month, which includes more focus on its partnership model.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Vistry’s Restructuring Efforts and Business Update

As part of its restructuring, the company will consolidate its operations into a single business with 27 regional business units, down from 32. Through this integration, the company expects to generate around £25 million in annualized cost savings.

Vistry also stated that the slowdown in private sales, witnessed in the summer months, is expected to continue due to higher interest rates and reduced customer budgets. On the plus side, it is confident about the demand for its mixed-tenure affordable homes for the remaining period of FY23, reflecting the strength of its diversified business model.

The company maintained its adjusted pre-tax profit guidance of £450 million for FY23. However, considering the estimated impact of reduced full-year site margins, the company’s target for adjusted profit before tax is £410 million.

Vistry Group is a house-building company with a presence in various segments of the UK housing market. The company places a strong emphasis on sustainability and is listed on the FTSE 250 index.

Are Vistry Shares a Good Buy?

Investors reacted negatively to the update, with the share price trending down by over 5% in early trading today. Since the announcement of the restructuring in September, the stock has lost around 20% in trading.

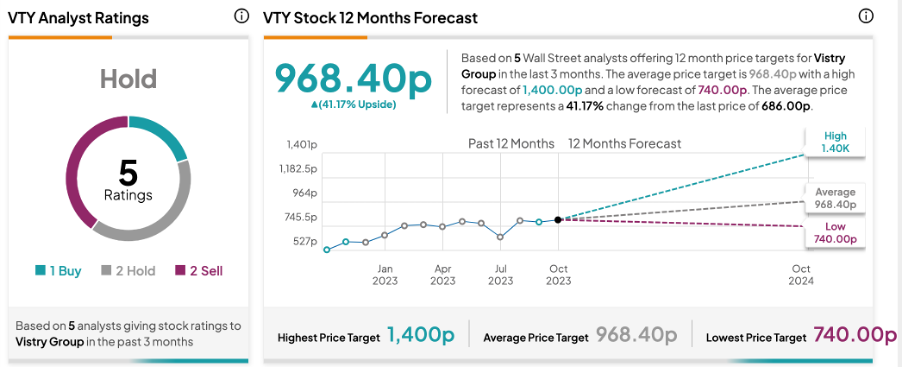

According to TipRanks, VTY stock has received a Hold rating based on a total of five recommendations. This includes one Buy, two Hold, and two Sell ratings from analysts. The Vistry share price target is 968.4p, which is 41% above the current trading levels.