The share price of the FTSE 250-listed property developer Vistry Group PLC (GB:VTY) gained over 14% today after the company announced shifting its focus towards the affordable housing business amid the slowdown in the overall housing sector. As part of its strategy update, the company stated that it would merge its housebuilding division with its partnerships business, which has been delivering superior returns. Under its partnerships business, the company works with government departments and other associations to build affordable homes.

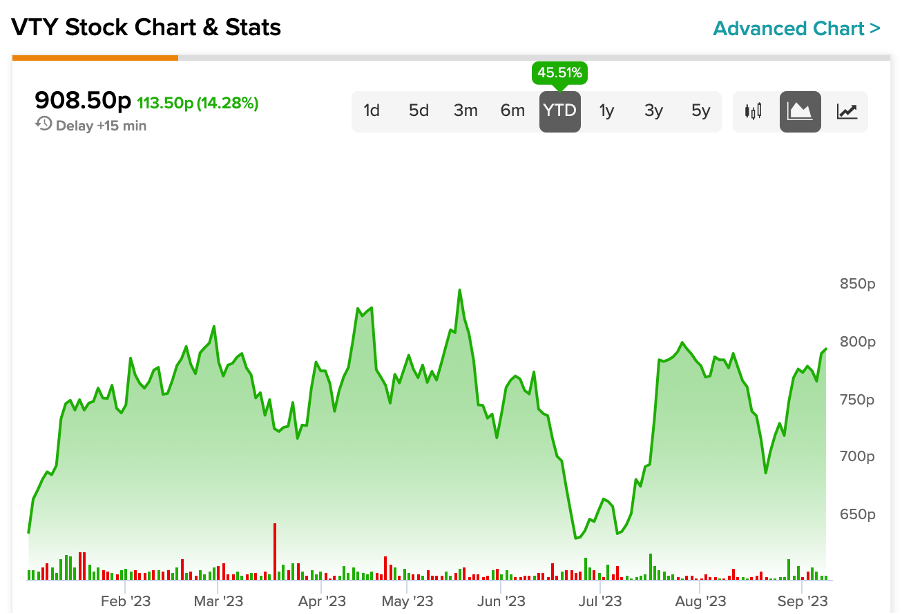

The company further announced its intention to return £1 billion to shareholders over the next three years, pushing the stock higher. As of writing, the Vistry share price was trading up by 14.09%. Despite the pressure from rising mortgage costs due to higher interest rates, the company’s stock has performed well in 2023. YTD, the stock has gained around 45%.

Vistry Group is a house-building company that develops homes and communities across the entire spectrum of the U.K. housing market, with a focus on sustainability. The company is a part of the FTSE 250 index.

Half-Year Performance and Revised Outlook

In its first-half earnings for 2023, the company completed 7,143 homes, which is 32% higher than last year’s numbers. Vistry reported an 8.4% decline in adjusted pre-tax profits for the first half of the year, amounting to £174 million. The partnerships segment experienced robust demand, resulting in adjusted revenues growing by 7.1% to reach £953.6 million, with margins increasing to 11.5% from 10.2%. On the contrary, revenues from the housebuilding segment declined by 28% to about £824 million.

Moving forward, the company’s revised targets include achieving a return on capital employed (ROCE) of 40%, annual revenue growth ranging from 5% to 8%, and an operating profit of £800 million. The company also confirmed its annual pre-tax profit projection of more than £450 million for 2023.

What is the Share Price Forecast for Vistry?

According to TipRanks, VTY stock has received a Moderate Buy rating based on a total of six recommendations, of which three are Buy. The Vistry share price target is 802.7p, which is 11.6% below the current trading levels.

It is important to note that these ratings were assigned well before the half-yearly results and are subject to potential revisions.