In today’s piece, we will discuss the price targets for SGX-listed companies United Overseas Bank (SG:U11) and Nanofilm Technologies International (SG:MZH). Among these two, UOB has a Strong Buy rating from analysts with a higher price target that its current price level. Nanofilm, on the other hand, has a Hold rating and a lower price target.

UOB Share Price Target

Based in Singapore, UOB’s banking services are focused mainly on Asian markets.

Just like its peers, UOB also delivered record numbers in its 2022 earnings. The bank’s net profit was up 18% to S$4.8 billion, well-supported by margin improvement across segments. The net interest income increased by 31% to S$8.3 billion in 2022 as compared to the previous year. The dividends were up by 25% to S$0.75 per share.

According to TipRanks’ rating consensus, U11 stock has a Strong Buy rating, based on seven Buy and two Hold recommendations.

The average price target is S$34.97, with an upside potential of almost 25%.

Nanofilm Share Price Target

Nanofilm is a leading provider of nanotechnology solutions across Asian markets.

Contrary to UOB, Nanofilm posted a dull performance in its results for 2022. The company posted a 30% decline in its net profit of S$43.8 million, as compared to 2021. This was an outcome of lower revenues and an increase in some expenses.

The management, however, is committed to reaching the target of S$500 million in revenues and S$100 million in profits by 2025.

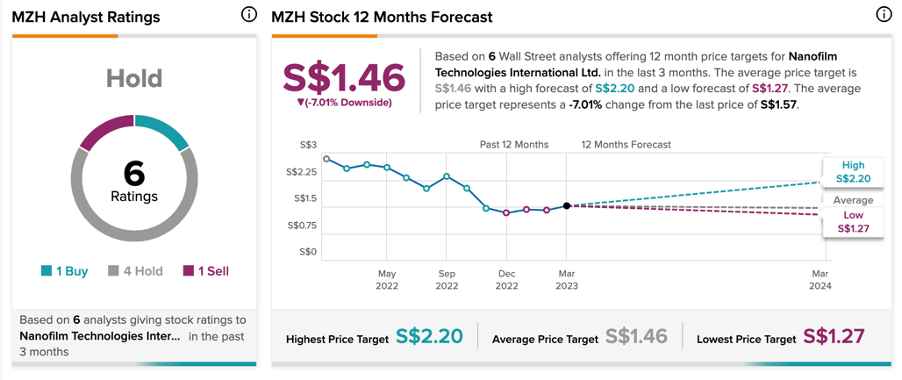

MZH stock has a Hold rating on TipRanks, based on four Hold, one Sell, and one Buy recommendations.

The price forecast is S$1.46, which is 7% lower than the current price level.

Conclusion

Among these two Singapore-based companies, UOB has a Strong buy rating with upside potential. The bank also remains a consistent dividend payer.

On the other hand, Nanofilm had a tough year, which was reflected in its 2022 earnings. Analysts gave the stock a Hold rating.